A Data-Driven Look at the AI-Driven DRAM Shortage

What’s in This Article

Cloud and Carrier Capital Spending Trends

Why DRAM Supply Is Not Fungible Across End Markets

Bit-Level View of Conventional DRAM vs HBM Supply

Why the AI-Driven DRAM Shortage Intensified Into 2025

Mitigating Supply Factors Begin to Emerge

Bit-Based HBM Supply–Demand Reconciliation

Inference as a Structural Driver of HBM Demand

When the Shortage Ends

Investor Implication

The shortage of DRAM associated with artificial intelligence workloads—particularly high-bandwidth memory—is now widely acknowledged across the semiconductor industry and among investors. What remains poorly understood is why this shortage persists despite ample supply of conventional DRAM for smartphones, PCs, and other mature end markets, and when the underlying imbalance will finally resolve. This article provides an empirical analysis of the AI-driven DRAM shortage using physical shipment data rather than revenue proxies, isolating the specific memory segments that constrain AI system deployment. By reconciling hyperscaler AI compute demand with bit-level memory supply, the analysis identifies when supply and demand dynamics finally come back into alignment.

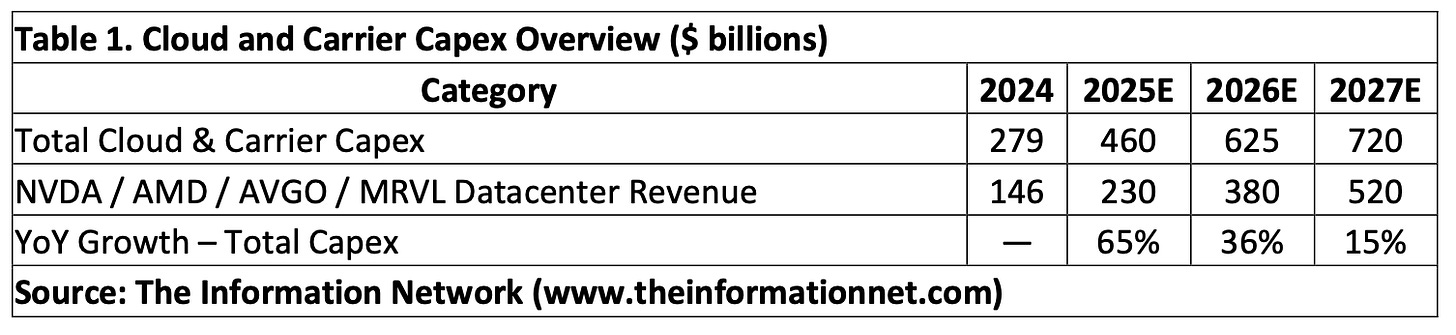

Cloud and Carrier Capital Spending Trends

According to Table 1, cloud and carrier capital expenditures continue to expand through 2027, driven primarily by investment in AI infrastructure rather than by traditional IT refresh cycles. Spending accelerated sharply in 2024 and 2025 as hyperscalers deployed GPU- and accelerator-dense systems for AI training and inference. A growing share of this spending is concentrated in compute platforms supplied by Nvidia, AMD, Broadcom, and Marvell, reflecting the shift toward specialized silicon architectures with exceptionally high memory bandwidth requirements. While absolute capex continues to rise, the deceleration in year-over-year growth after 2026 signals a transition from rapid build-out toward optimization and utilization of installed capacity. This distinction matters because memory demand is tied directly to accelerator deployments, not to aggregate datacenter spending.

A recurring mistake in discussions of the DRAM shortage is the assumption that