Arm Holdings' Expanding Role in AI

Summary

ARM is expanding its presence in AI data centers, with projected revenue reaching $13 billion by 2028, representing 27% of the market.

ARM's Neoverse platform offers high-performance computing and AI capabilities, challenging Intel and AMD in the data center sector.

In the PC edge AI market, ARM's relationship with Apple and the integration of Armv9 architecture in future M-series chips will be a catalyst for ARM.

In the smartphone market, ARM continues to dominate, powering over 95% of smartphones worldwide.

Introduction

Analysts at Morgan Stanley have recently elevated Arm Holdings plc (NASDAQ: ARM) to their top large-cap pick, expressing strong confidence in Arm's growth potential, particularly in the mobile recovery and emerging edge AI opportunities. Morgan Stanley maintained an Overweight rating with a $175 price target, reflecting optimism in Arm's ability to leverage the expanding edge AI market, largely driven by the integration of its v9 architecture into high-performance devices, including Apple's iPhone 16.

Analysts project a 35% compound annual growth rate (CAGR) in Arm's mobile segment from FY24 to FY27, with additional growth anticipated from the automotive and infrastructure sectors. The recent launch of Apple's iPhone 16, featuring Arm's v9 architecture within the A18 chip, marks a significant milestone for the company. These v9 cores are expected to significantly boost Arm's presence, particularly in the mobile segment, with an expected shipment of 230-260 million iPhone units in FY26, positioning Arm for substantial royalty revenue growth.

Morgan Stanley further emphasized Arm's critical role in the transition to edge AI, highlighting that the company's silicon intellectual property (IP) is increasingly being adopted across various industries. This growing demand for custom silicon solutions is expected to drive higher royalty rates for Arm over the next two to three years.

ARM's Expanding Role in AI

ARM Holdings is rapidly expanding its presence across multiple markets, particularly in artificial intelligence (AI) data centers, PC edge AI, and smartphones. Leveraging its innovative Neoverse platform, ARM is now a formidable player, challenging incumbents like Intel Corporation (NASDAQ: INTC) and Advanced Micro Devices, Inc. (NASDAQ: AMD) in the data center space. The company’s projected revenue growth, driven by the integration of its processors in AI-driven workloads, positions ARM as a leader in the evolving AI ecosystem, which is expected to see explosive growth across sectors.

Data Centers

ARM's growing influence in AI data centers is becoming increasingly evident as major cloud service providers such as Amazon’s (AMZN) AWS, Alphabet's (GOOG) Google Cloud, Microsoft’s (MSFT) Azure, and China-based Alibaba (BABA) Cloud adopt ARM-based solutions. These cloud providers rely on ARM’s architecture to meet the needs of their scalable and high-performance AI and data processing requirements. ARM's Neoverse platform is tailored for the kind of complex, high-performance workloads these data centers demand, providing an alternative to traditional x86 architectures from Intel and AMD.

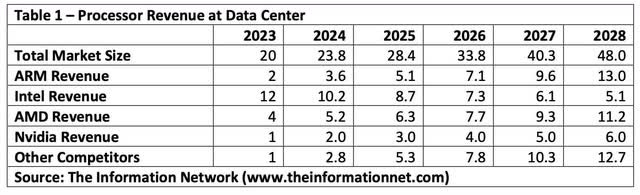

The projected compound annual growth rate (CAGR) for the AI data center market remains robust at 19.1%, growing from $20 billion in 2023 to $48 billion by 2028, according to The Information Networks' report Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive, and Memory Chips. ARM's Neoverse architecture has been instrumental in this expansion, particularly with the rising demand for high-performance, energy-efficient processors.

I estimate that by 2028, ARM's revenue in the AI data center market will reach $13 billion, representing 27% of the market, as shown in Table 1.

The processors for these companies in 2023 and 2024 are as follows in Table 2: