Broadcom’s AI Infrastructure Surge: A Paradigm Shift in AI Investments

Summary

Colossal Market Reaction: Broadcom added over $300 billion in market cap across two sessions following its blockbuster earnings, outperforming all S&P 500 constituents for consecutive days.

AI Infrastructure Dominance: Broadcom’s leadership in Ethernet switches (70% market share), custom silicon, and advanced 3.5D packaging positions it as a critical enabler of AI scalability.

$90 Billion Opportunity: The company projected $60 billion to $90 billion in AI custom silicon revenue by fiscal 2027, signaling substantial growth potential as hyperscalers shift toward optimized AI infrastructure.

Nvidia Divergence: While Nvidia remains dominant in compute with GPUs, Broadcom’s success highlights increasing investor appetite for infrastructure solutions that complement GPU workloads.

Investor Rotation: Broadcom’s more balanced valuation and infrastructure-driven strategy offer an attractive alternative to Nvidia’s premium-priced compute dominance, reflecting a paradigm shift in AI investments.

1. Introduction

Broadcom (NASDAQ: AVGO) has emerged as a cornerstone of the AI revolution, driving critical infrastructure solutions for hyperscaler and enterprise data centers. Unlike Nvidia, which dominates AI compute with its GPUs, Broadcom focuses on enabling the seamless scalability of AI workloads through Ethernet switches, custom silicon (ASICs), and advanced packaging technologies.

Following its recent earnings report, Broadcom’s double-digit stock surge across two sessions added over $300 billion in market cap, signaling a significant shift in investor sentiment. The company’s long-term projection of $60 billion to $90 billion in AI custom silicon revenue by fiscal 2027 underscores its pivotal role in the AI ecosystem. As hyperscalers like Google, Meta, Microsoft, and Amazon prioritize infrastructure efficiency, Broadcom’s foundational technologies are becoming indispensable.

While Nvidia remains dominant in AI compute, Broadcom’s infrastructure solutions are driving investor recognition of the growing importance of AI scalability and efficiency—a narrative that positions Broadcom for sustained long-term growth.

This article explores Broadcom’s financial strength, market opportunity, competitive positioning, and technical innovations that make it a key investment for the AI boom.

2. Financial Performance and Growth Projections

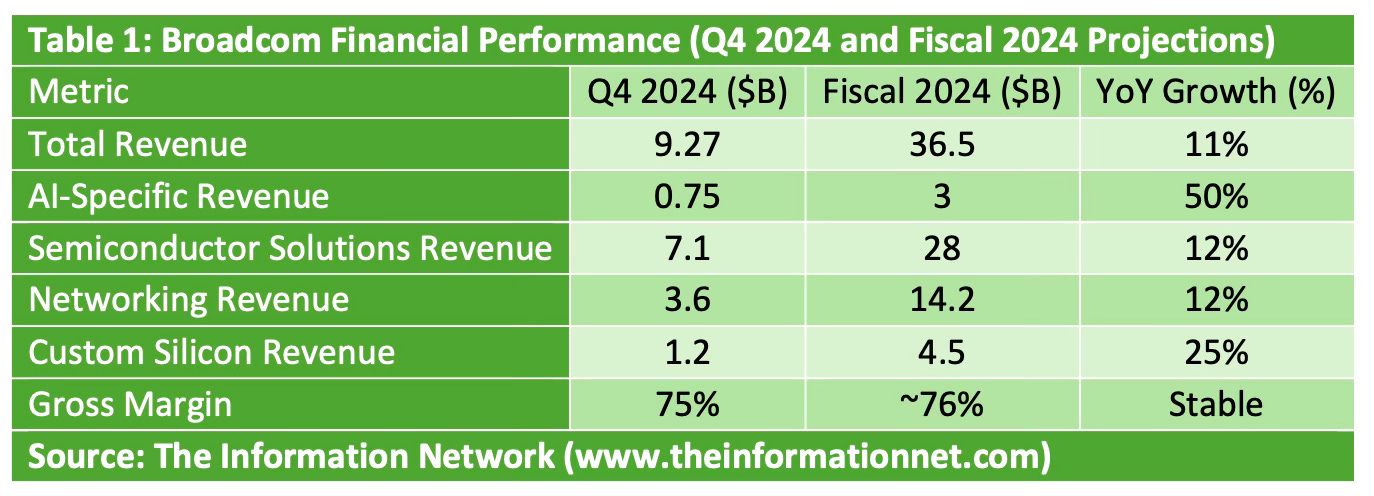

Broadcom’s Q4 2024 earnings demonstrate its robust growth, driven by AI-related demand in networking and custom silicon. AI-specific revenue grew by 50% year-over-year, and Broadcom’s long-term guidance highlights even greater upside.

Table 1 below outlines Broadcom’s key financial metrics for Q4 2024 and its fiscal 2024 projections.

These results highlight Broadcom’s ability to capture AI-driven infrastructure demand while maintaining strong margins. CEO Hock Tan’s guidance for $60 billion to $90 billion in custom AI silicon revenue by fiscal 2027 aligns perfectly with anticipated AI infrastructure spending.

Chart 1 illustrates various aspects of Broadcom’s income for the quarter.

Chart 1

3. Broadcom’s Role in AI Infrastructure

3.1 Networking: Driving AI Scalability

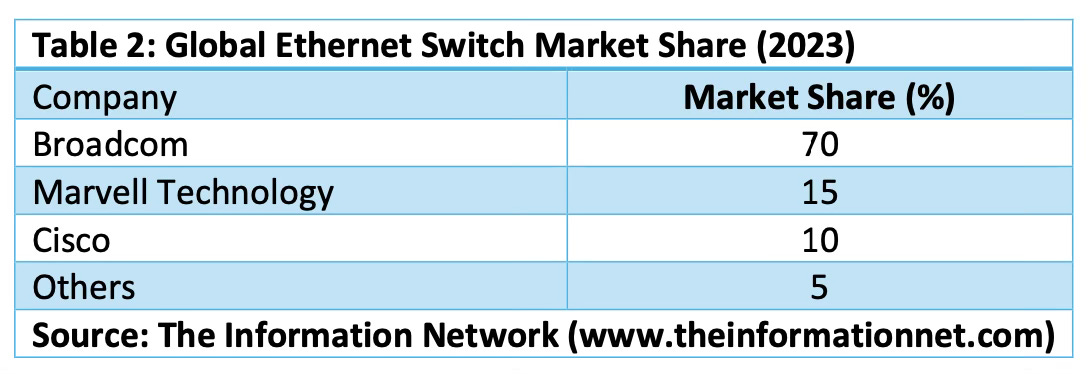

Broadcom dominates the Ethernet switch market, which forms the backbone of modern AI clusters. Its Tomahawk 5 switch, launched in 2023, delivers an industry-leading 51.2 Tbps of bandwidth. This enables hyperscalers like Google, AWS, and Meta to scale large GPU clusters efficiently, reducing data bottlenecks.

Table 2 below highlights Broadcom’s commanding position in the global Ethernet switch market.

With leadership in 800G Ethernet technology, Broadcom supports the scaling of AI workloads while reducing latency and power consumption. Hyperscalers like AWS, Microsoft, and Meta depend on Broadcom’s networking solutions for scaling next-generation AI clusters.

3.2 Custom Silicon: The $90 Billion Opportunity

Broadcom’s application-specific integrated circuits (ASICs) represent a transformative opportunity within AI infrastructure. Unlike general-purpose GPUs, Broadcom’s ASICs are custom-designed to optimize specific AI workloads such as training, inference, and data preprocessing.

Through close partnerships with hyperscalers like Google, Meta, Microsoft, and Bytedance, Broadcom co-develops ASICs that deliver:

Higher efficiency through task-specific optimization.

Lower power consumption compared to GPUs.

Cost reductions by eliminating unnecessary general-purpose features.

Key ASIC Partnerships are:

Google TPU v5: Co-developed with Broadcom, Google’s TPU powers its Gemini AI models, leveraging 3nm fabrication for efficiency and performance.

Meta MTIA: Meta’s large-scale inference workloads depend on Broadcom’s ASICs for content recommendations and ad targeting.

Microsoft Maia: Microsoft’s AI accelerators, designed in collaboration with Broadcom, reflect sustainability and AI compute optimization goals.

Bytedance: TikTok’s video workloads utilize Broadcom’s 5nm and 3nm ASICs to enhance performance and reduce energy consumption.

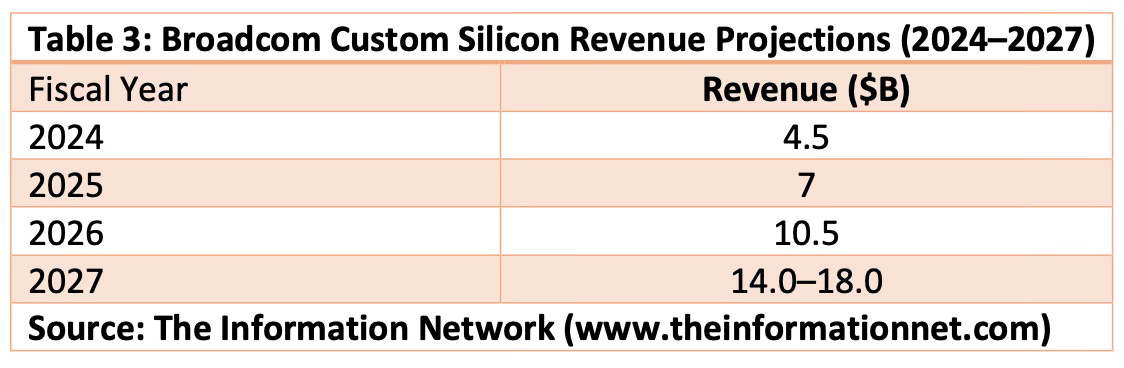

Table 3 below outlines Broadcom’s projected growth in custom silicon revenue.

These projections align perfectly with Broadcom’s long-term revenue guidance of $60 billion to $90 billion, positioning the company to capture a significant share of the growing AI infrastructure market.