Gina Raimondo, Ex-Secretary of Commerce under Biden, Has Morphed into Soon-to-be Ex-Undersecretary of Commerce Under Trump

The New Front: Washington Turns on Its Allies

A new front has opened in the semiconductor export control war—this time not aimed directly at China, but at America’s own allies. Jeffrey Kessler, Under Secretary at the Commerce Department’s Bureau of Industry and Security (BIS), recently informed executives at Samsung Electronics, SK Hynix, and Taiwan Semiconductor Manufacturing Company (TSMC) that he intends to cancel the waivers currently allowing them to ship U.S.-origin chipmaking equipment to their advanced manufacturing facilities in China. These waivers, originally granted in 2022, have allowed these companies to sustain high-volume memory and logic production in their China-based fabs without going through time-consuming U.S. license reviews.

Billion-Dollar Fabs, Political Fragility

The move has triggered immediate and coordinated pushback from Seoul and Taipei, who see this as a unilateral escalation that may threaten the strategic partnership they have maintained with the United States. At stake are not only billions of dollars in fab investments in China, but also the goodwill these companies have extended to Washington in recent years by announcing massive U.S. factory projects. TSMC, for instance, is building two fabs in Arizona with an eventual investment expected to top $65 billion. Samsung has committed at least $25 billion for its Texas fab, with more potentially in the pipeline. SK Hynix, while less active in U.S. fab construction, has quietly shifted portions of its DRAM and NAND R&D efforts to the U.S. in recent years.

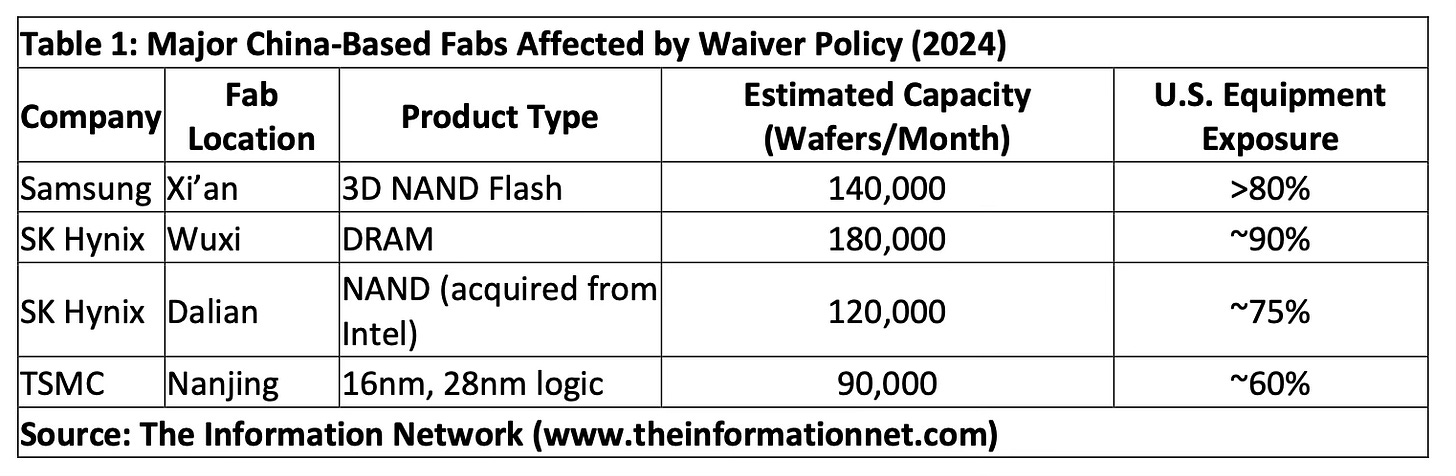

According to Table 1, from The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends,”the facilities directly exposed to a potential waiver cancellation include Samsung’s flagship NAND fab in Xi’an, SK Hynix’s DRAM and NAND operations in Wuxi and Dalian, and TSMC’s Nanjing logic fab. These sites represent core revenue-generating assets for each company, with U.S.-origin equipment comprising 60 to 90 percent of their tooling base. The operational risk is not just hypothetical—it is embedded in the supply chain architecture of Asia’s most strategically important fabs. Without streamlined export approvals, every routine upgrade or maintenance cycle becomes a geopolitical calculation.

Operational Uncertainty Replaces Policy Stability

Operational friction: Without waivers, Samsung’s Xi’an memory fab, SK Hynix’s Wuxi and Dalian fabs, and TSMC’s China operations would be forced to operate under a case-by-case licensing regime, likely slowing or outright blocking shipments of essential U.S.-origin tools. This not only threatens efficiency but introduces major uncertainty into future upgrade and maintenance cycles.

A Strategic Miscalculation, or a Deliberate Trial Balloon?

The political calculation from Washington appears to be aimed at harmonizing policy—Kessler reportedly favors aligning China rules for allies with the treatment of U.S. firms like Intel, Micron, and Texas Instruments, which must apply for licenses. Yet this blanket approach fails to consider the broader diplomatic context. The Korean and Taiwanese governments have reportedly expressed frustration behind closed doors, noting that the U.S. is placing strategic burden on allies while offering little compensation in return. Diplomats from both countries are now pushing for an interagency review and urging the U.S. Defense Department to block or water down the proposed restrictions.

The U.S. Supply Chain Is Also on the Hook

Adding to the tension is the impact on U.S. equipment suppliers. The share prices of Applied Materials, Lam Research, and KLA fell between 3% and 5% following reports of Kessler’s plans. These companies derive up to 30% of their annual revenues from Chinese customers, with a meaningful portion linked to foreign-operated fabs in China.

According to Table 2, from The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts,”