KLA is Down Since Its Earnings Call Indicates Investors are Clueless About the Semiconductor Industry

KLA Corporation (NASDAQ: KLAC) reported strong financials and issued robust forward guidance in its recent earnings call, yet the stock dropped more than 3%. At the same time, Seagate and Western Digital—two companies whose futures are arguably more dependent on KLA’s tools than they are on their own flash marketing cycles—saw their stocks rise over 7% following earnings reports that lacked the same level of clarity or forward visibility. This divergence is a perfect example of how investor misunderstanding continues to distort semiconductor valuations, especially for companies like KLA, which sit at the foundational layer of chip manufacturing.

KLA is the undisputed leader in process control, inspection, and metrology. Without its tools, it is impossible to scale to advanced nodes like 5nm and 3nm—let alone the upcoming 2nm and gate-all-around (GAA) architectures that are central to Nvidia’s roadmap. In fact, the more advanced the node, the greater the need for comprehensive inspection and overlay metrology, where KLA’s market share exceeds 60%. Its equipment is used not just in front-end fabs but increasingly in advanced packaging, where chiplets and 2.5D/3D integration further compound the need for process precision. KLA’s dominance is not cyclical—it is structural.

Why KLA Leads — And Will Keep Leading

As semiconductor manufacturing pushes into extreme ultraviolet (EUV), backside power delivery, high-bandwidth memory (HBM), and 3D stacking, process control is becoming mission critical. KLA is the market leader here — and its dominance is only growing.

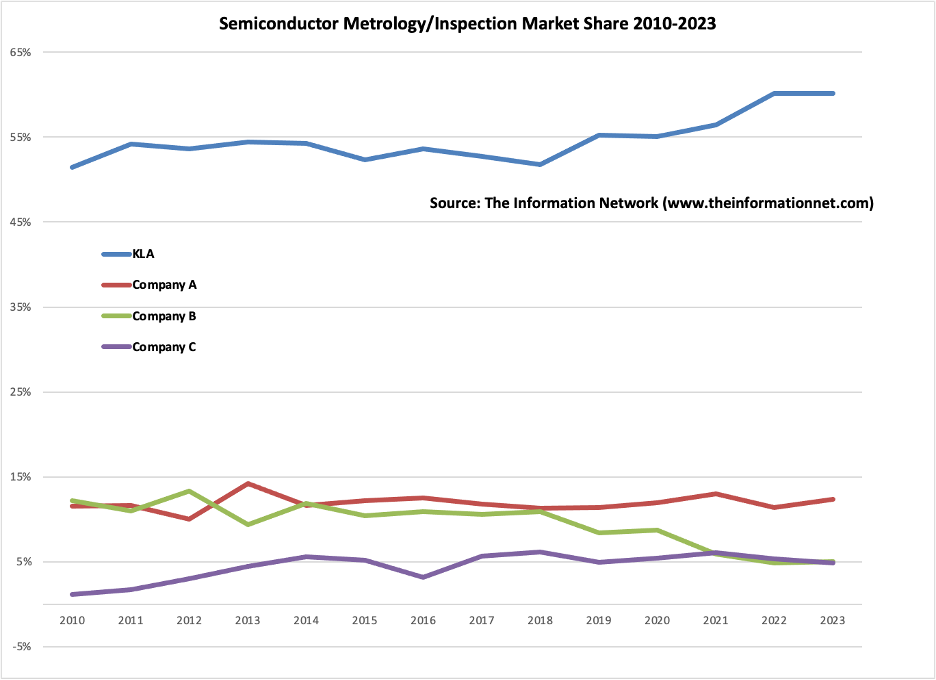

In the semiconductor metrology and inspection segment, KLA has grown its market share from just over 50% in 2010 to over 60% in 2023, while competitors have either plateaued or declined.

Chart 1: KLA vs. Competitors — Metrology & Inspection Market Share (2010–2023)

This chart is sourced from my report: Metrology, Inspection, and Process Control in VLSI Manufacturing, details of which are available on my website at www.theinformationnet.com.

With AI, HPC, and automotive chips requiring increasingly precise manufacturing, KLA’s solutions are now indispensable for yield control and defect detection. Unlike AMAT and Lam, KLA has stayed on a consistent upward path — and the trend is accelerating.

That structural importance is lost on investors who remain focused on headline narratives around AI chip providers while ignoring the enablers. Nvidia’s continued dominance in AI training—and increasingly in inference—has accelerated data center growth worldwide. Yet, Nvidia’s chips, including the H100, H200, and Blackwell B100, rely entirely on leading-edge TSMC nodes that cannot be produced without KLA’s inspection and metrology platforms. There is no alternative. Without KLA, you don’t get the defect density needed to yield an H100. You don’t even get the interposer for a high-bandwidth memory stack.

This lack of understanding mirrors what we’ve seen before with Nvidia itself. When Broadcom and Marvell announced strong earnings earlier this year, Nvidia’s stock dropped, despite the fact that neither firm competes with Nvidia in training workloads. Marvell is focused on custom inference chips and optical interconnects. Broadcom designs off-the-shelf accelerators and custom ASICs for cloud providers. The market’s reaction implied cannibalization where none exists. Investors failed to understand that these companies serve orthogonal functions in the AI data center architecture—and that Nvidia, far from being threatened, sits atop the hierarchy as the training compute standard.

KLA suffers from the same misattribution. While investors chase stocks like Seagate and Western Digital on hopes of AI-driven data storage growth, they ignore the fact that without high-yielding chips enabled by KLA tools, the entire AI infrastructure stack collapses. Data centers do not function in a vacuum—they depend on validated silicon, precisely aligned layers, and defect-free chiplets, especially as 3D packaging becomes more prevalent. The ramp of Nvidia’s Blackwell architecture, the HBM3E memory it requires, and the interconnect packaging developed by TSMC CoWoS all depend on KLA's inspection systems. When TSMC doubles its CoWoS capacity, it is implicitly doubling its reliance on KLA.

The irony here is that investors appear more willing to reward downstream enablers that sit several steps removed from actual chip production than the upstream providers like KLA, which are the linchpins of yield. KLA reported sequential growth, beat on EPS, and guided positively—not only for legacy logic and memory but for long-term growth tied to AI infrastructure. And yet, a 3% drop suggests a market incapable of parsing supply chain dependencies.

We’ve seen this pattern repeatedly in recent quarters. Applied Materials, Lam Research, and ASML often get credit for fab expansion, but KLA’s role in ensuring those fabs produce usable silicon goes underappreciated. Similarly, Micron’s surge in HBM revenue has boosted investor sentiment, yet the inspection tools needed to validate TSV bonding and wafer-to-wafer alignment are all KLA's domain. The further the industry moves into 3D packaging, advanced nodes, and chiplet architectures, the more central KLA becomes.

KLA’s recent drop should be seen as a market inefficiency. It reflects a lack of comprehension, not a lack of performance. Unlike commodity memory suppliers or SSD vendors, KLA has high-margin recurring business and one of the deepest moats in semiconductor equipment. Its dominance is not cyclical. It is process-embedded. And it is critical to the continued success of companies like Nvidia, which investors have—ironically—come to recognize as irreplaceable.

It is no coincidence that Seagate and Western Digital surged after touting growth tied to AI-related data center deployments. But without recognizing that this growth is ultimately driven by Nvidia chips, which are themselves only manufacturable with the help of KLA tools, investors are trading on narratives instead of understanding the full value chain.

What’s needed is deeper domain knowledge—precisely the kind of technical and market insight that underpins this analysis. Investors cannot afford to treat semiconductor supply chains as interchangeable parts. From fab tools to final inference chips, every layer has its own hierarchy, and KLA is near the very top of that list.

Investor Takeaway

KLA’s post-earnings decline is a misread. Its financials are strong, its forward guidance is solid, and its role in enabling advanced AI semiconductors is foundational. The stock is down not because of performance, but because of a knowledge gap in the market. As we saw with Nvidia, Broadcom, and Marvell, investor confusion over competitive dynamics and chip supply chains creates volatility—but also opportunity. Those who understand that AI infrastructure begins at the wafer level, not just the GPU level, will recognize KLA’s strategic value. For long-term investors, this is not a signal to exit—it’s a signal to double down.

In my 40 years tracking the semiconductor equipment industry, I’ve never seen a divergence quite like this.

While most eyes are on Applied Materials (AMAT) and Lam Research (LRCX) — and their shifting fortunes in deposition and etch — it’s KLA (KLAC) that's quietly emerging as the most resilient and strategic player in wafer fabrication equipment (WFE).

Based on exclusive analysis from my latest report, Applied Materials: Competitive Analysis of Served Markets, the market share trajectories of these three companies tell a compelling story.