What’s in This Article

This article analyzes Micron Technology’s competitive positioning in the 2025 memory market, focusing on why its strong engineering execution has not translated into strategic leadership. It explores the AI-driven shift in DRAM and NAND demand, pricing dynamics, and platform access. The article also contrasts Micron’s progress with that of Samsung and SK hynix using six detailed charts, highlighting shipment trends, ASPs, and revenue across DRAM and NAND. The structural gap between Micron’s technology roadmap and its absence from key AI infrastructure sockets is central to the investment discussion.

The Memory Race Has Shifted — And HBM Is the Battleground

SOCAMM: Micron’s Surprise Breakout in AI Memory

Brilliant Engineering, Unanchored Strategy

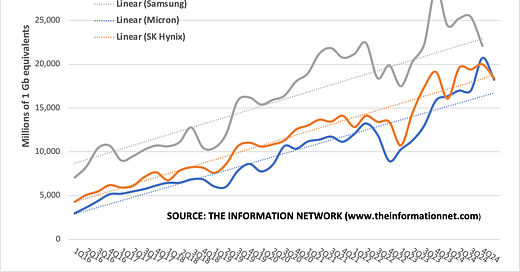

Chart 1: DRAM Shipments – Millions of 1Gb Equivalents

Chart 2: DRAM ASPs – $/Gb

Chart 3: DRAM Revenue – $ Millions

Chart 4: NAND Shipments – Millions of 16Gb Equivalents

Chart 5: NAND ASPs – $/Gb

Chart 6: NAND Revenue – $ Millions

Pricing Power Without Platform Power

Investor Takeaway

Introduction

The future of memory is accelerating, but Micron Technology (MU) still finds itself racing to catch up. The company’s progress in high-bandwidth memory (HBM), DRAM node scaling, and Gen9 NAND are commendable — even formidable — in their own right. And yet, the larger story remains: a great technology company still starved for the strategic altitude that defines market leaders. It’s not a matter of innovation, but integration — not of bits, but of business positioning.

Micron’s Q2 2025 performance surprised to the upside, yet the stock fell. A price hike announcement on April 1 failed to lift sentiment. And following the shockwave of Trump’s renewed China tariffs, Micron lost 16% in a day — the second-worst performer on the Nasdaq-100. This is not how Wall Street reacts to an industry leader; it’s how it punishes a company with promise but no power.

Mizuho raised its price target on Micron this past week to $130 per share, with an outperform rating. Looking ahead to Micron's fiscal Q3 2025 earnings report, which is expected June 25, Mizuho expects to see strong guidance based on a couple of big numbers.

Brilliant Engineering, Unanchored Strategy

Micron’s engineering division deserves accolades. The 12-stack HBM3e modules it has delivered are ahead of schedule and aligned with customer roadmaps. Its 1-Gamma DRAM ramp — the company’s first EUV node — is progressing with remarkable yield stability. Gen9 NAND is poised to power next-generation PCIe Gen5 SSDs. Technologically, Micron is no longer a follower.

But it remains uninvited to the high tables.

No Nvidia GB200 socket. No dominant AI data center design wins. No anchoring in hyperscaler infrastructure strategies. Micron is supplying memory — but not defining platforms. Samsung and SK hynix have succeeded in embedding themselves into the platform logic of their customers. Micron remains a vendor, not a co-architect.

This is not a problem of bits. It is a problem of business model positioning.