My Top Two ETFs for Two Different Types of Investors

Summary

SMH vs. VOO: SMH offers concentrated exposure to the booming semiconductor sector, while VOO provides diversified access to 500 large U.S. companies across multiple industries.

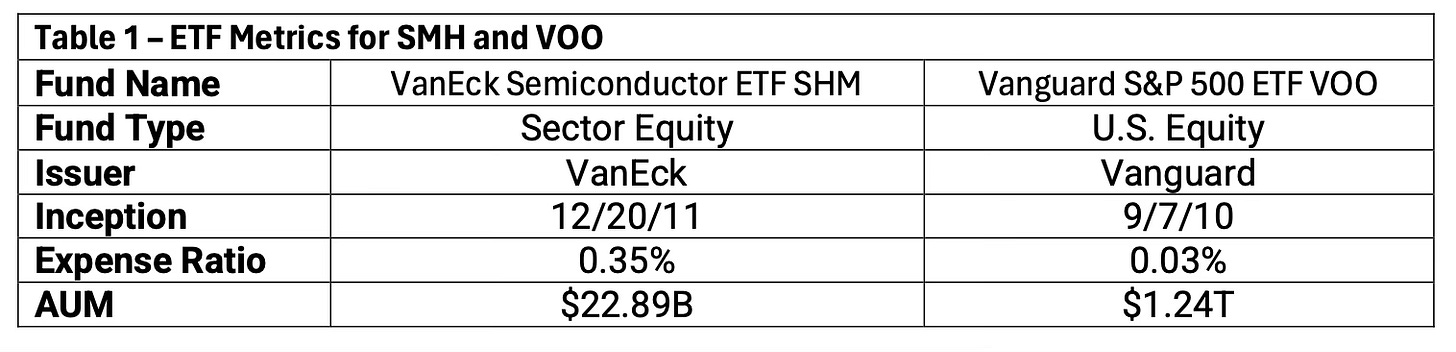

Expense Ratio and AUM: SMH's expense ratio is 0.35% compared to VOO's ultra-low 0.03%, with VOO managing $1.24 trillion in assets vs. SMH's $22.89 billion.

Performance Comparison: SMH has outpaced VOO in long-term returns, with 876.3% over 10 years, while VOO offers steadier growth, delivering 192.0% over the same period.

Investor Takeaway: SMH is best suited for high-growth, high-risk investors focused on semiconductors, while VOO caters to those seeking diversified, lower-risk, steady returns across the broader market.

Introduction

When comparing the VanEck Semiconductor ETF (SMH) and the Vanguard S&P 500 ETF (VOO), it’s clear that these two funds cater to distinct investor preferences. SMH, being a sector-focused ETF, provides concentrated exposure to the semiconductor industry, while VOO offers a broad, diversified representation of the U.S. stock market. SMH has a higher expense ratio at 0.35%, reflecting its specialized exposure, while VOO’s extremely low 0.03% expense ratio appeals to cost-conscious investors seeking broad market stability. Despite SMH’s smaller assets under management ($22.89 billion compared to VOO’s $1.24 trillion), its focus on high-growth semiconductor companies has led to strong performance, particularly over the last year.

VanEck Semiconductor ETF SMH

SMH is an exchange-traded fund (ETF) managed by Van Eck Associates Corporation. The fund focuses on growth and value stocks from companies across various market capitalizations, aiming to replicate the performance of the MVIS US Listed Semiconductor 25 Index through a full replication strategy. With assets under management (AUM) of $22.66 billion, SMH's largest holding is NVDA, with a 20.7% allocation, followed by TSM at 14.2% and AVGO at 8.6%. The fund holds a total of 15 stocks.

SMH has a relatively low expense ratio of 0.35%, compared to the category average of 0.58%. Its net asset value (NAV) is currently $237.83, and the fund has attracted $6.02 billion in inflows over the past year.

The ETF provides an annual dividend of $1.04, yielding 0.44% at the current price. Over the past four years, it has averaged a dividend yield of 0.85%. Dividend payouts have increased at a compound annual growth rate (CAGR) of 11.6% over three years and 5% over five years.

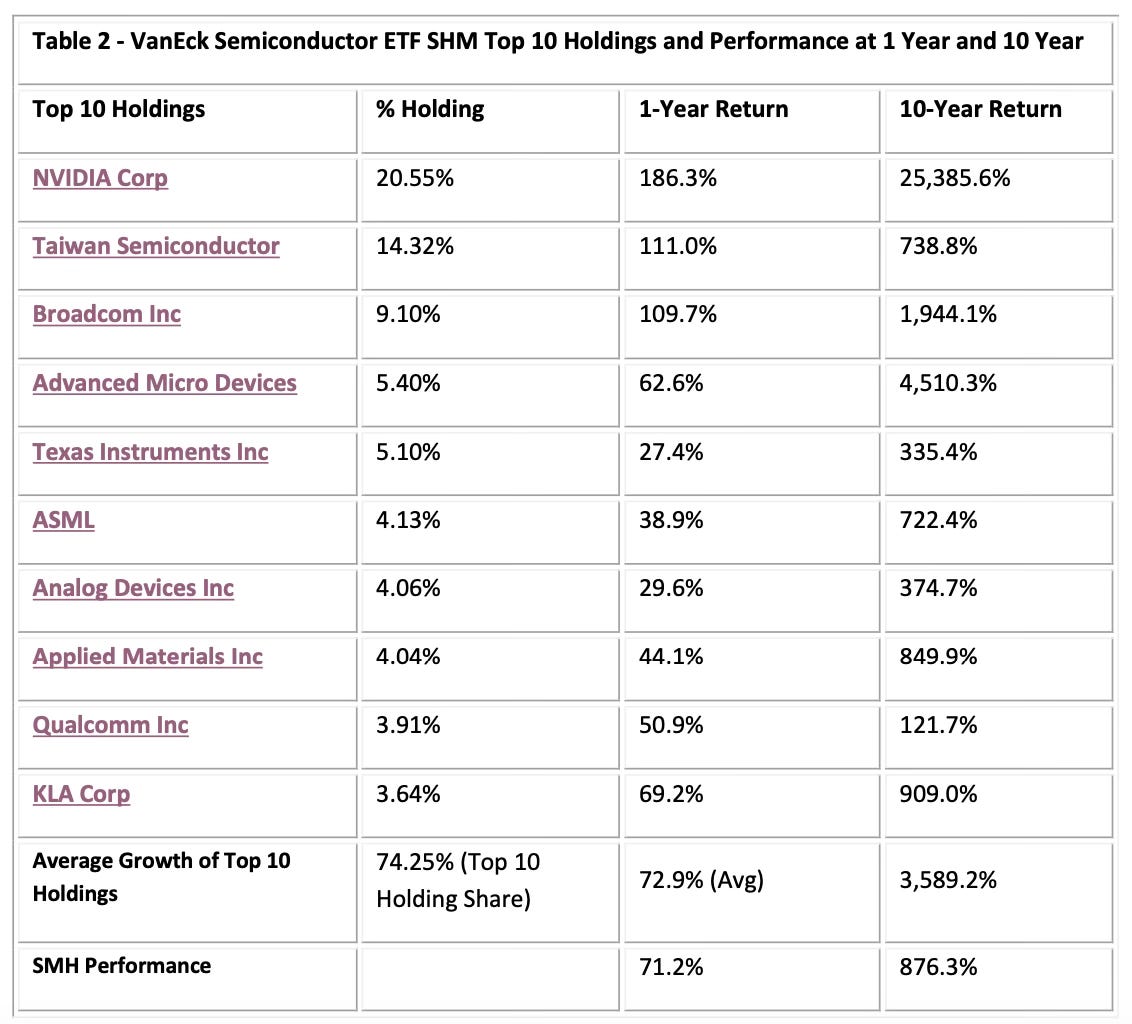

In terms of performance of Top 10 Holdings, SMH has surged 72.9% over the last year and 3,589.2% over the past 10 years, as shown in Table 2.

In terms of market performance, SMH share price has surged 71.2% over the last year and 876.3% over the past 10 years, as shown in Table 2.

Vanguard S&P 500 ETF VOO

The Vanguard 500 Index Fund ETF, known as VOO, tracks the performance of the S&P 500 Index, a benchmark of the U.S. stock market. VOO, launched by Vanguard in 2010, aims to provide a low-cost, diversified way to invest in large U.S. companies that mirror the index's weighting. Based in Valley Forge, Pennsylvania, VOO is designed for investors seeking exposure to the broader stock market at a low cost.