Nvidia's CEO Jensen Huang Kills Quantum Stock Momentum

Summary

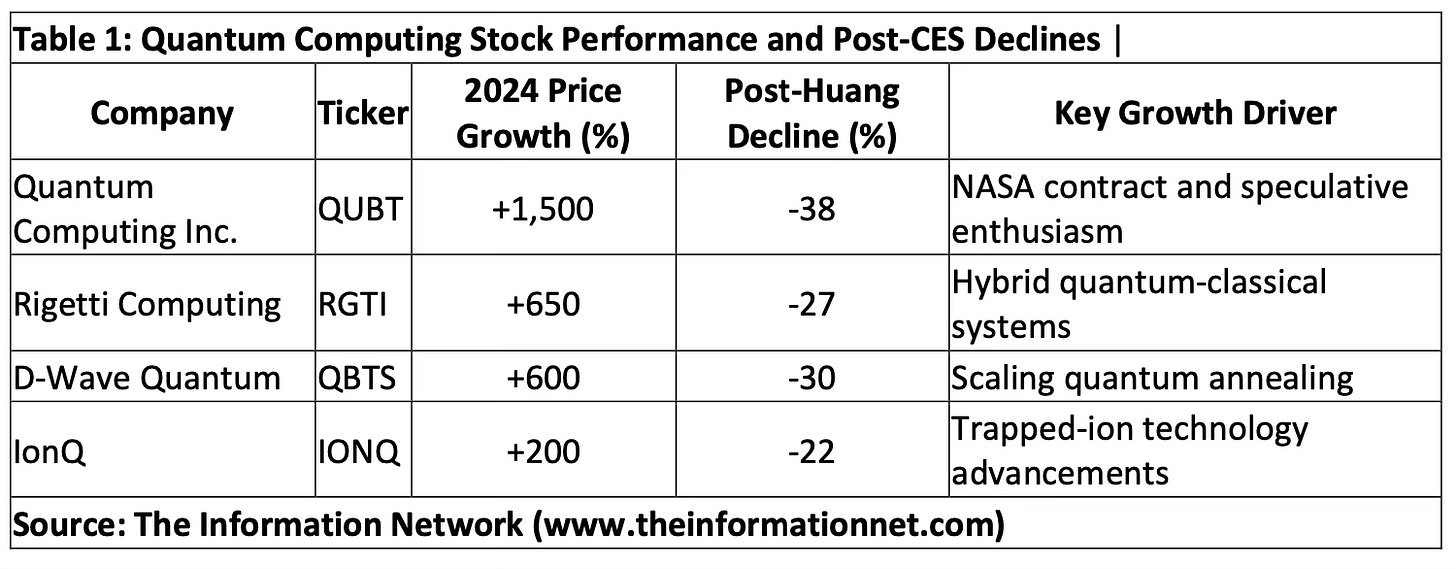

Quantum Stock Collapse: Quantum Computing Inc. (QUBT) fell 38%, with Rigetti (RGTI), D-Wave (QBTS), and IonQ (IONQ) also suffering sharp post-CES losses.

Jensen Huang's Sobering Reality: Nvidia's CEO emphasized that quantum computing remains "decades away from practical implementation," redirecting attention to AI-accelerated classical systems.

Financial Fragility Exposed: Revenue growth in the quantum sector remains incremental, with companies like IonQ showing promise, but most still unprofitable and reliant on speculative enthusiasm.

Investor Sentiment Recalibrated: Nvidia's critique sets a clearer benchmark for assessing quantum computing's true commercial viability, driving a market correction in overvalued stocks.

Future Path to Watch: Long-term potential in hybrid quantum-classical systems and scalable quantum solutions still exists, but disciplined evaluation of fundamentals is now critical.

Section 1: Revisiting the Quantum Computing Stock Frenzy

Just days ago, in my Substack article "Quantum Computing Stocks: Breakthrough Opportunity or Speculative Bubble?", we delved into the remarkable 2024 rise of quantum computing stocks. Companies like Quantum Computing Inc. (QUBT), Rigetti Computing (RGTI), IonQ (IONQ), and D-Wave Quantum (QBTS) experienced unprecedented gains, driven by groundbreaking technological announcements like Google’s Willow processor and Amazon’s Quantum Embark program. These developments stoked investor enthusiasm, positioning the quantum sector as one of the hottest markets of the year.

However, Nvidia CEO Jensen Huang’s recent comments during the CES keynote have abruptly shifted the narrative, triggering a dramatic sell-off across the sector. Huang’s statement that quantum computing is "decades away from practical implementation" underscored the speculative nature of these stocks and brought their valuations into question.

Section 2: Jensen Huang’s Comments and the Market’s Reaction

Huang’s remarks emphasized Nvidia’s dominance in AI-accelerated classical computing while casting doubt on the near-term viability of quantum technologies. He pointed out the immense technical hurdles facing quantum computing, including error correction, scalability, and limited use cases, stating:

"Quantum computing is fascinating science, but it’s not ready for primetime and won’t be for decades. AI-accelerated classical systems are solving the same problems faster, more efficiently, and at scale."

This stark commentary juxtaposed with Nvidia’s recent breakthroughs in AI, highlighted a broader market reality: classical computing remains the dominant force in addressing computational challenges, with quantum computing still in its infancy.

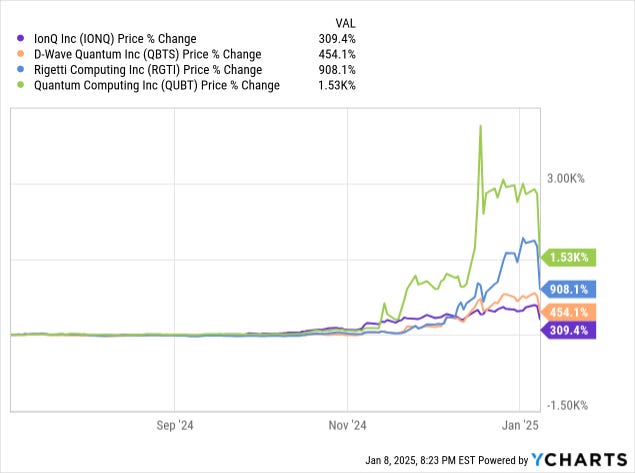

The market reaction was swift and brutal. Stocks that had skyrocketed in 2024 faced sharp declines in early 2025, underscoring the speculative nature of their recent valuations.

Table 1 shows the share price performance before Huang’s comment and the 1-day share price afterward.

Chart 1 illustrates the explosive rise followed by the fall for the past 6-months.

Chart 1

Section 3: Financial Realities and Market Fundamentals

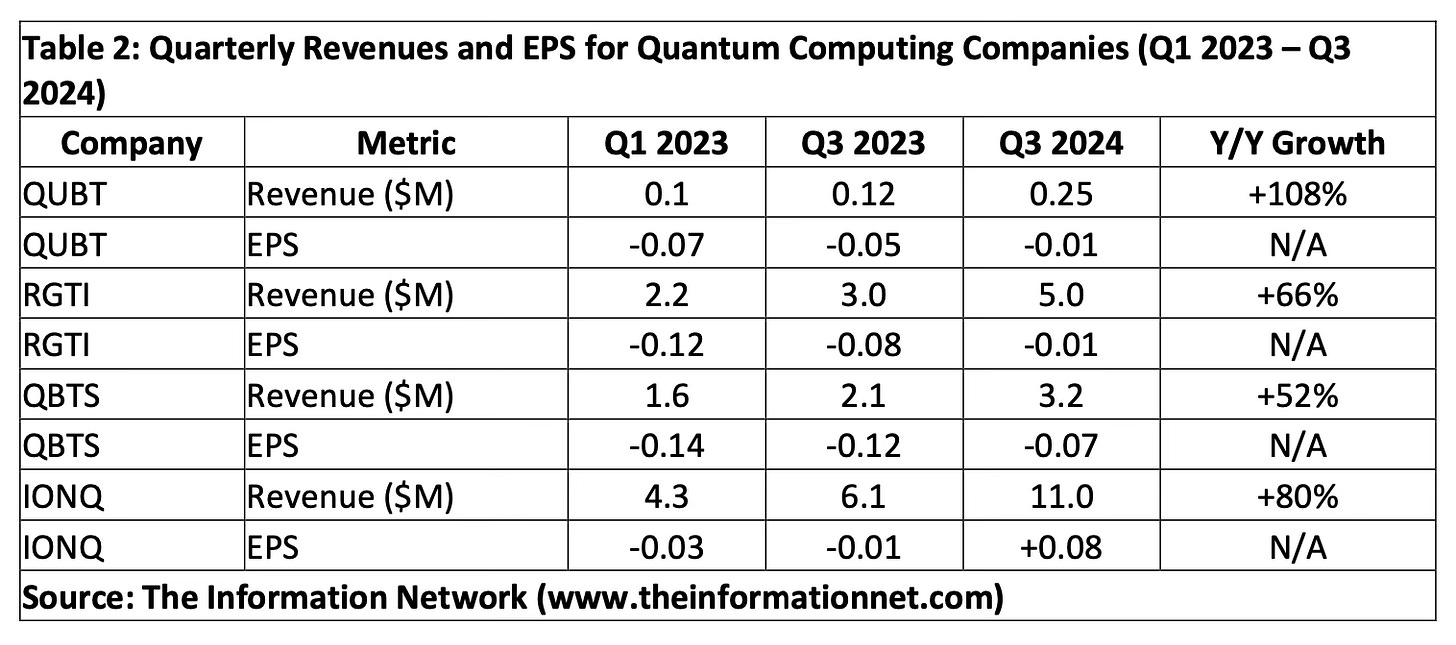

Huang’s comments exposed the underlying financial vulnerabilities of quantum computing companies. As highlighted in the first article, these firms have shown incremental revenue growth but remain unprofitable, with earnings heavily reliant on venture capital and government funding, as shown in Table 2.

While IonQ and Rigetti show encouraging revenue growth, none of these companies’ earnings justify the explosive 2024 stock performance, further validating the speculative bubble argument posed in the earlier article.

Section 4: Evaluating the Investor Takeaway

In my previous article, my “investor takeaway” highlighted the high-risk, high-reward nature of quantum computing stocks. It advised caution, emphasizing the need to differentiate between speculative hype and fundamental progress. Huang’s remarks have reinforced this perspective, exposing the market’s vulnerability to shifts in sentiment.

However, the earlier takeaway also acknowledged the long-term potential of companies like IonQ, Rigetti, and D-Wave, which continue to show technological progress and growing adoption in niche applications. Investors with a long-term horizon may find opportunities amid the volatility, but speculative enthusiasm must give way to disciplined analysis.

Section 5: Looking Ahead

The sharp corrections following Nvidia’s CES keynote mark a turning point for quantum computing stocks. As the market recalibrates expectations, the focus will shift to tangible milestones, including:

· Achieving scalable quantum systems with robust error correction.

· Commercializing quantum solutions in industries like AI, logistics, and encryption.

· Developing hybrid quantum-classical systems to address near-term computational challenges.

While Nvidia’s critique may have deflated speculative momentum, it also sets a clearer path for serious investors to assess the sector’s true potential.

Updated Investor Takeaway

Quantum computing remains a revolutionary technology with immense long-term potential. However, Nvidia’s comments underscore the importance of a measured approach to investing in this space. The sharp corrections in stocks like QUBT and RGTI reveal the dangers of speculative exuberance and the need for due diligence.

For investors, the earlier analysis holds true:

Focus on Fundamentals: Companies like IonQ, which demonstrate real-world adoption and revenue growth, may present opportunities for long-term investors.

Avoid Speculative Frenzy: Sharp declines highlight the risks of chasing momentum without grounding in fundamentals.

Assess the Timeline: Quantum computing is a marathon, not a sprint. The path to commercialization remains lengthy and uncertain.

Nvidia’s critique has tempered the speculative frenzy, providing a necessary reality check. Investors should use this opportunity to reevaluate their strategies, prioritizing companies with clear technological advantages and pathways to profitability over those riding the wave of hype.