Nvidia’s H20 Crackdown Was Inevitable—U.S. Licensing Marks the End of Loophole-Led AI Sales to China

The hoarding of over $16 billion in Nvidia chips by Chinese tech giants is just the surface—cloud sharing, resale schemes, and weak compliance all led to Washington taking control of the company’s AI

Introduction

In April 2025, the U.S. government imposed a license requirement on Nvidia’s H20 chip exports to China. To most, it appeared sudden—a political move or a sanction. But for those who’ve been watching closely, it was the logical next step in a pattern I first warned about in 2023: U.S. export controls were failing not because they didn’t exist, but because companies like Nvidia allowed themselves to be outmaneuvered. I refer readers to my October 2023 Seeking Alpha article entitled “Nvidia's A100 And H100 AI Chips Are Another Failure Of U.S. China Sanctions.”

Back then, it was cloud sharing. Today, it’s physical hoarding. In both cases, Nvidia’s powerful AI chips—whether through hourly cloud access or direct shipments—became the foundation of China’s national AI push, and U.S. regulators finally stepped in to shut the backdoor.

But there was also a deeper strategic trigger. Trump administration officials reportedly viewed China’s DeepSeek—an emerging frontier model developer believed to have trained using Nvidia chips—as a digital equivalent of the Chinese surveillance balloon that crossed U.S. airspace in early 2023. DeepSeek wasn’t just a commercial venture—it was seen as a symbol of unchecked AI progress in China, potentially enabled by lax U.S. enforcement. To the Trump administration, allowing Nvidia chips to fuel that growth was a policy failure that needed to be reversed—immediately and decisively.

In this exclusive analysis, I trace the collapse of Nvidia’s compliance strategy from cloud-sharing circumvention in 2023 to full-scale chip hoarding in 2024—and explain why the April 2025 license requirement is not a sanction, but a necessary handoff of control to the U.S. government.

This isn’t just about China. It’s about what happens when a company builds the future—and loses control of where it goes.

The Cloud Rental Loophole That Broke Export Controls

In my October 2023 Seeking Alpha article, I documented how blacklisted Chinese firms were accessing Nvidia A100 and H100 chips via cloud rental platforms—FluidStack, CoreWeave, even Microsoft Azure. These chips, banned from direct sale, were suddenly accessible for as little as $10 per hour. Companies like iFlytek and SenseTime, already under U.S. sanctions, were reportedly accessing them using intermediaries.

Nvidia’s response was typical of the era: distributors were “expected” to follow U.S. rules, but no meaningful oversight followed. This was the beginning of a pattern where Nvidia would technically comply with U.S. regulations while enabling their circumvention in practice.

From Cloud Rental to Chip Hoarding: China’s AI Strategy Scales

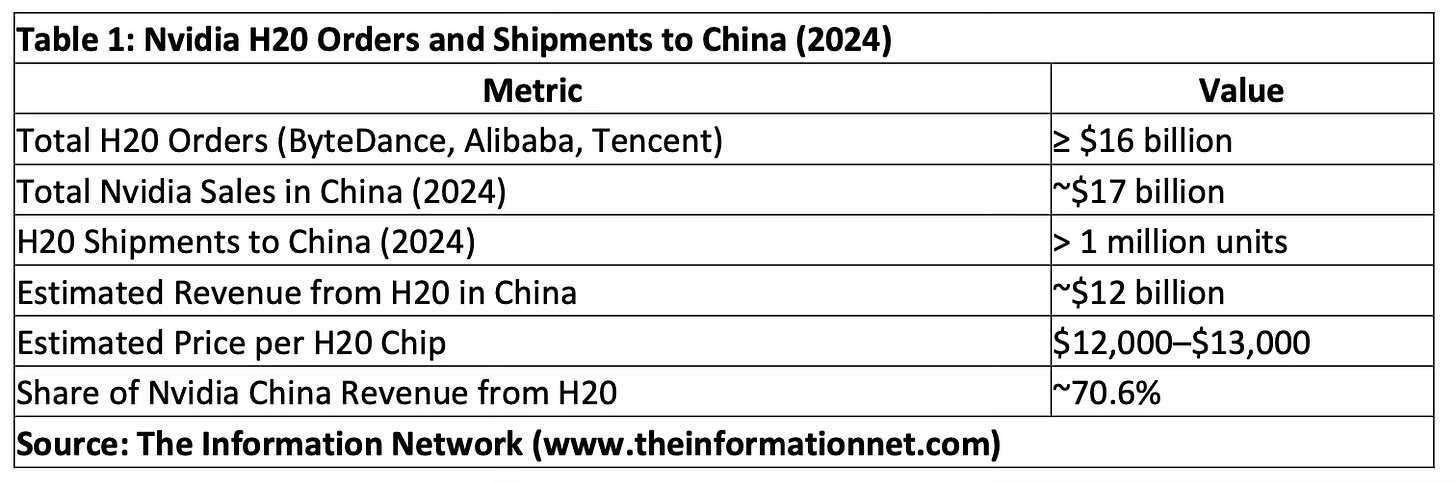

Table 1 summarizes Nvidia’s H20 sales into China during 2024. ByteDance, Alibaba, and Tencent placed massive orders totaling at least $16 billion, representing nearly all of Nvidia’s reported China revenue. More than 1 million units were shipped, making the H20 the most hoarded AI chip in China’s short tech history.