Summary

Ollie’s Outpaces Competitors in Profitability: Ollie’s achieved a gross margin of 41.4% in Q3 2024, far exceeding Dollar Tree’s 30.9% and further highlighting its superior cost management compared to Big Lots, whose gross margin remains unavailable due to ongoing financial struggles.

Operational Efficiency Drives Results: Ollie’s operating margin improved to 8.6%, surpassing Dollar Tree’s 7.4% and significantly outperforming Big Lots, which reported a negative -20.3% operating margin, reflecting its severe inefficiencies.

Net Income Highlights a Stark Contrast: Ollie’s net income reached $44.3 million, equivalent to an 8.5% net income margin, while Big Lots reported a net loss of $205 million, underlining the ongoing financial disparity between the two retailers.

Inventory Growth Signals Strength: Ollie’s inventory increased 14.1% year-over-year, driven by store expansion and improved receipt timing, compared to Dollar Tree’s modest 5% growth and Big Lots’ inventory decline linked to liquidation efforts.

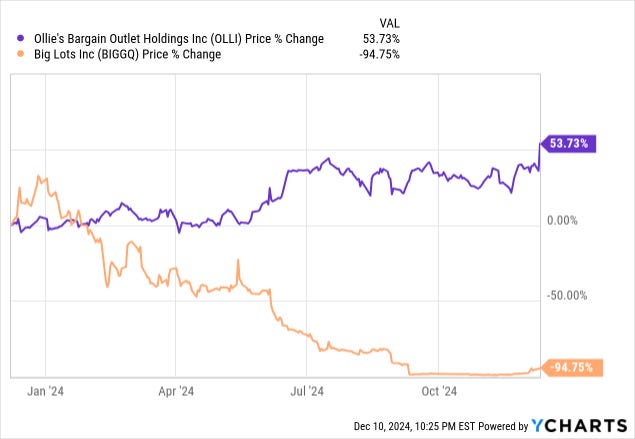

In my September 9, 2024 Substack article entitled “Accumulate Ollie’s as Big Lots Goes Bankrupt: A Profitability Comparison for Investors,” I suggested to readers that with the Chapter 11 filing by major competitor Big Lots (BIGGQ), then was the time to accumulate shares of Ollie’s (OLLI).

At the time of that writing, Ollie’s share price was up 19.5% and Big Lots was down 91.2%.

Three months later, Ollie’s 1-year share price is up 53.73% and Big Lots is down 94.75%, as shown in the chart below. To those of you how listened to me, congratulations you made money.

Ollie's Bargain Outlet Holdings (NASDAQ: OLLI) traded higher on December 10, 2024 following the release of its fiscal Q3 earnings report, which aligned closely with analysts’ expectations. Nexus Capital Management's potential acquisition of Big Lots under Chapter 11 bankruptcy offers a chance to restructure the struggling retailer. Acting as a "stalking horse bidder,"

Nexus could streamline operations by closing underperforming stores and focusing on profitable categories like furniture and seasonal items. With $707.5 million in secured financing, Nexus aims to stabilize Big Lots’ financial position and leverage its expertise in distressed investments to reposition the brand. However, challenges such as declining sales and rising competition may complicate the turnaround, requiring effective execution and adaptability.

For the quarter ending November 2, total net sales rose 7.8% year-over-year to $517.4 million. Comparable store sales saw a slight decline of 0.5%, reflecting a challenging comparison to the prior year when comparable sales surged 7.0%. The company achieved a 100-basis-point improvement in gross margin, reaching 41.4% of sales, driven by reduced supply chain costs, although partially offset by lower merchandise margins due to a higher mix of consumables. Operating margin increased by 50 basis points to 8.6%, reflecting improved cost control.

On the balance sheet, Ollie’s ended the quarter with $303.9 million in cash and $264.0 million in short-term investments. The company reported no outstanding borrowings under its $100 million revolving credit facility and had $92.1 million in remaining availability. Inventory levels rose 14.1% year-over-year to $607.3 million, attributed to new store openings and the timing of inventory receipts.

CEO John Swygert commented,

"We had another great quarter and are pleased with our results. We delivered strong earnings on higher sales, gross margin, and disciplined expense control. We also took advantage of a number of real estate opportunities that strengthened our new store pipeline and enhanced our competitive positioning for the future."

Looking ahead, Ollie’s forecasts fiscal Q4 sales in the range of $2.27 billion to $2.28 billion, with a midpoint slightly below the consensus estimate of $2.28 billion. Earnings per share are projected between $3.22 and $3.30, with a midpoint of $3.26, just below the consensus estimate of $3.27.

Competition

Table 1 highlights the financial and operational differences among the three discount retailers in the latest quarter, providing a clear picture for investors assessing growth and stability in this competitive sector. Ollie's excels in profitability with its high gross margin and positive earnings, while Dollar Tree's (DLTR) scale drives substantial revenue. In contrast, Big Lots faces ongoing financial challenges, reflected in its negative earnings and declining same-store sales.