Semiconductor Equipment Market Pointing to Negative Growth in 2024

To all readers. Substack is now the exclusive domain for my articles. Readers will no longer find them on Seeking Alpha. Any subscriptions to my articles will only come through Substack, and if you were a Paid Subscriber for my Semiconductor Deep Dive Newsletter, consider Substack.

Summary

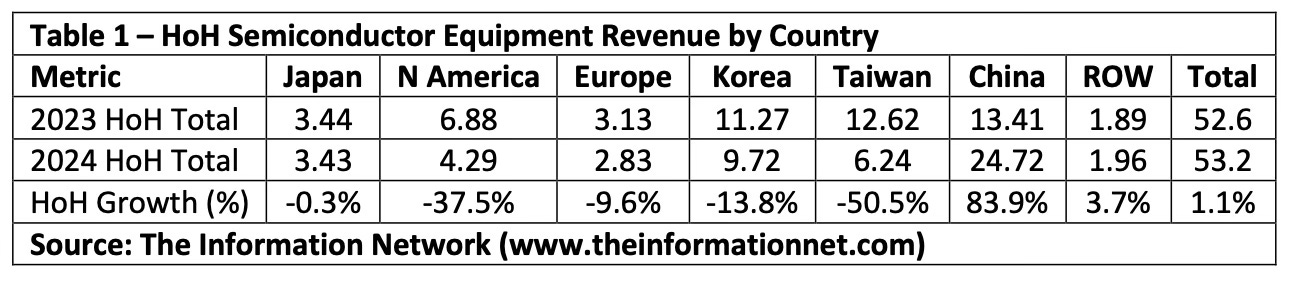

China’s semiconductor equipment market grew significantly by 83.9% in 1H 2024 compared to 1H 2023, driven by substantial domestic investment.

Semiconductor equipment revenues increased just 1.1% from 1H 2023 to 1H 2024.

Semiconductor unit shipments decreased by 1.3% from 1H 2023 to 1H 2024,

Wafer Front End (WFE) spending by major semiconductor manufacturers is projected to decrease by 5.5% in 2024, indicating a potential slowdown in equipment investments.

Applied Materials will be the most impacted, since in just Q2 2024 it lost $300 million from cuts by Intel as well as $750 million in sales to China.

In my June 23, 2021 article entitled Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023, I discussed how high capex spend would result in a downturn in semiconductor equipment sales in 2023 and 2024.

My 2021 thesis for a semiconductor equipment meltdown in 2023 was moderated by several mitigating factors such as memory downturns and hoarding of equipment by Chinese semiconductor companies. I attempted to show how actual WFE results would have been closer to my thesis if these unforeseen factors had not happened.

This article points to factors that validate my 2024 analysis of a downturn. Also in this article, I also reconcile the semiconductor and equipment revenue discrepancies.

My analysis of semiconductor equipment revenues, manufacturing organizations, and employment data reveals significant variations across countries for 1H 2024 versus 1H 2023. China's substantial growth contrasts with declines in North America, Europe, and Taiwan, influenced by investment patterns, competitive pressures, and changes in end-product markets.

By examining specific organizations and employment trends, we gain a clearer understanding of the factors driving these regional performance variations in the semiconductor equipment market.

Chart 1 illustrates the HoH change by country.

Chart 1

Semiconductor Analysis

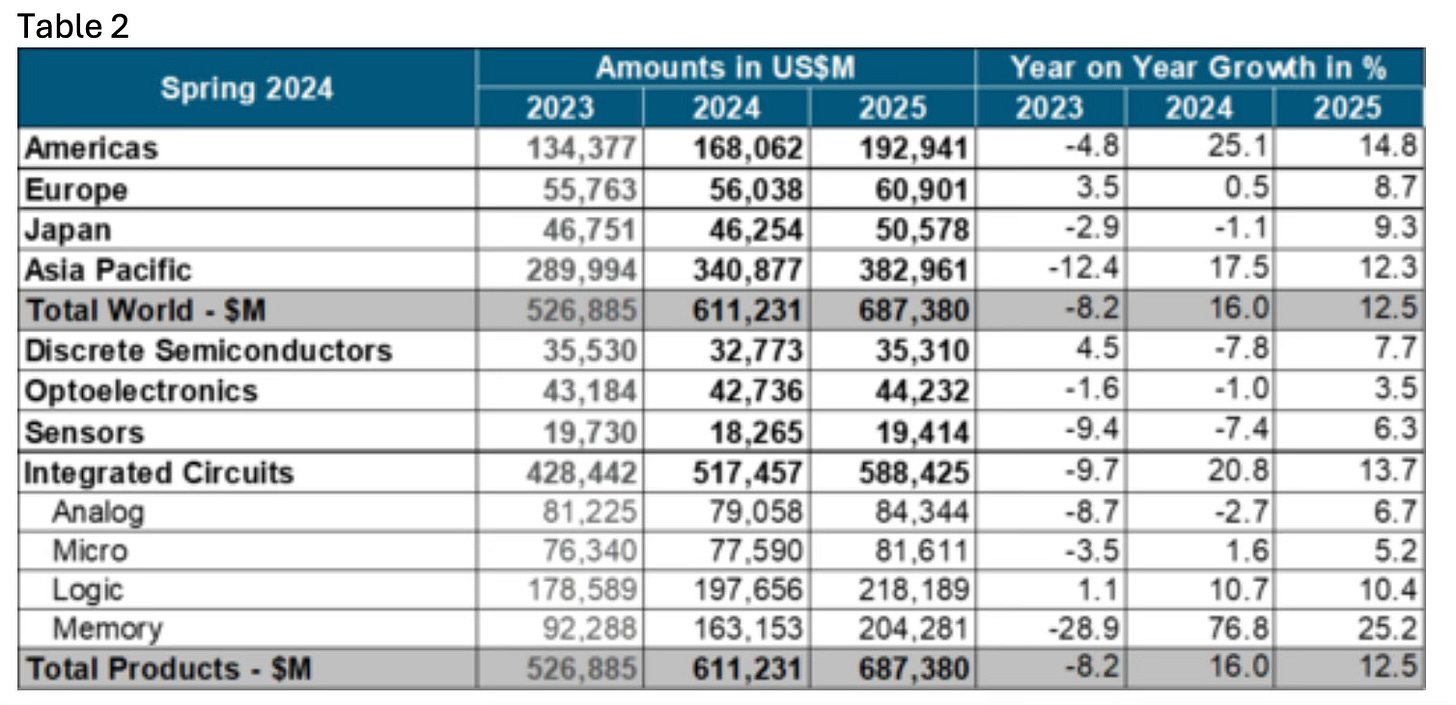

World Semiconductor Trade Statistics (WSTS) is projecting a 16.0 percent growth in the global semiconductor market compared to the previous year, as shown in Table 2. Meanwhile, the Semiconductor Industry Association (SIA) announced on August 5 global semiconductor industry sales totaled $149.9 billion during the second quarter of 2024, an increase of 18.3% compared to the second quarter of 2023. WSTS also aligns with this data, reflecting robust demand across various semiconductor applications.