Semiconductor Industry: A Comprehensive 2025 Outlook - Part 1

In this series of articles on the semiconductor and semiconductor equipment markets, I discuss three topics:

Nvidia’s dominance in AI GPUs (92% market share in 2023) and expanding demand for AI processors underscore the central role of advanced computing in driving the semiconductor industry forward.

Global wafer fab equipment (WFE) spending is expected to stabilize in 2025 with a modest 2% decline, driven by regional shifts, geopolitical incentives, and demand for advanced nodes.

TSMC’s continued investments in 3nm and 5nm technologies highlight its unmatched expertise in high-performance chip production, with 3nm revenue expected to double to $20 billion by 2025.

In subsequent articles I will address different sectors. Data come from two reports by The Information Network report:

Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive, and Memory Chips.

Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

Introduction

The semiconductor and semiconductor equipment industries are poised to play an even more critical role in 2025 as technological advancements continue to accelerate across artificial intelligence (AI), automotive electrification, and high-performance computing (HPC). These industries are foundational to the modern economy, enabling innovations that drive progress in every sector from consumer electronics to healthcare and autonomous vehicles. Companies like Nvidia (NVDA), TSMC (TSM), Micron Technology (MU), and KLA Corporation (KLA) are not only shaping these trends but are also at the forefront of responding to unprecedented challenges, including supply chain disruptions, geopolitical tensions, and cyclical market pressures.

In 2025, the semiconductor ecosystem is set to see significant growth in advanced nodes, packaging technologies, and memory innovations, driven largely by the increasing complexity of AI workloads and the global push toward renewable energy and automation. Nvidia’s dominance in the AI hardware space, TSMC’s leadership in sub-5nm manufacturing, and Micron’s focus on high-bandwidth memory (HBM) highlight how these companies are redefining the competitive landscape. Similarly, KLA Corporation’s dominance in process control underscores the indispensable role of precision and yield management as nodes shrink and production complexity increases.

This report explores the key trends, challenges, and opportunities shaping the semiconductor and equipment markets. From the rising demand for AI processors and the stabilization of wafer fab equipment (WFE) spending to advancements in memory and process control technologies, each section provides a detailed analysis of the forces driving innovation and growth in 2025. The industry’s evolution will not only reshape global supply chains but also create new opportunities for investors seeking exposure to the next wave of technological breakthroughs.

1. AI and High-Performance Computing (HPC)

Artificial intelligence has emerged as the most transformative force in technology today, driving advancements across diverse sectors such as healthcare, automotive, finance, and entertainment. As AI models grow more sophisticated, the demand for computational power has surged, placing high-performance computing (HPC) systems and advanced GPUs at the core of this revolution. Nvidia, as the dominant player in the AI GPU market, has redefined what is possible in machine learning, natural language processing, and computer vision, ensuring its leadership as the industry rapidly expands.

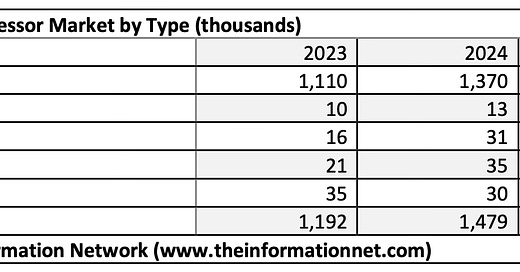

AI Processor shipments reached 1,192,000 units in 2023 generating revenue of $27.18 billion. In 2024, shipments increased by 24% to 1,479,000 units and $33.7 billion in revenue, with projections for 2025 reaching 2,147,000 processors and $41.99 billion in revenue

In 2025, unit shipments will reach 2,147,000 processors and generate revenues of $41.99 billion, according to The Information Network report entitled Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive, and Memory Chips.

GPUs: Expected to grow at an average annual growth rate (CAGR) of approximately 20%, driven by surging demand for AI training and inference.

FPGAs: Forecasted to grow at a steady rate of 10% per year, as they are increasingly used for specific AI tasks and edge computing.

ASICs: Anticipated to grow at 15% annually, boosted by major advancements in custom AI hardware.

NPUs: Projected to grow at 18% CAGR, supported by integration into consumer devices and enterprise hardware.

CPUs: Expected to grow at around 8% annually, reflecting steady demand from data center and edge computing applications.