Taiwan Semiconductor - Dominating AI Chip and Package Production

Taiwan Semiconductor Manufacturing Company (TSMC) delivered impressive second-quarter results, surpassing analysts' expectations driven by strong demand for artificial intelligence (AI) chips.

TSMC reported a 40% year-over-year revenue increase, reaching 673.51 billion New Taiwan dollars ($20.62 billion), outperforming market predictions. Profits also saw a substantial rise, climbing over 36% to NT$247.85 billion ($7.59 billion), exceeding forecasts. Earnings per share came in at NT$9.56, or $1.48 per ADR, both figures outpacing estimates.

Looking ahead, TSMC anticipates robust demand in the third quarter for AI and smartphones. The company expects third-quarter sales to range between $22.4 billion and $23.2 billion, representing a growth of approximately 30% to 33% from the $17.28 billion reported in the same period last year.

“Our strong performance in the second quarter was fueled by high demand for our leading 3nm and 5nm technologies, although it was partially offset by typical smartphone seasonality,” commented TSMC CFO Wendell Huang. “As we move into the third quarter of 2024, we anticipate continued strength in smartphone and AI-related demand for our advanced process technologies.”

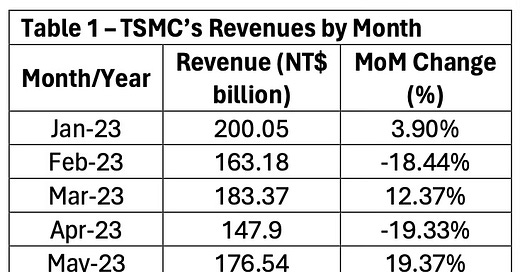

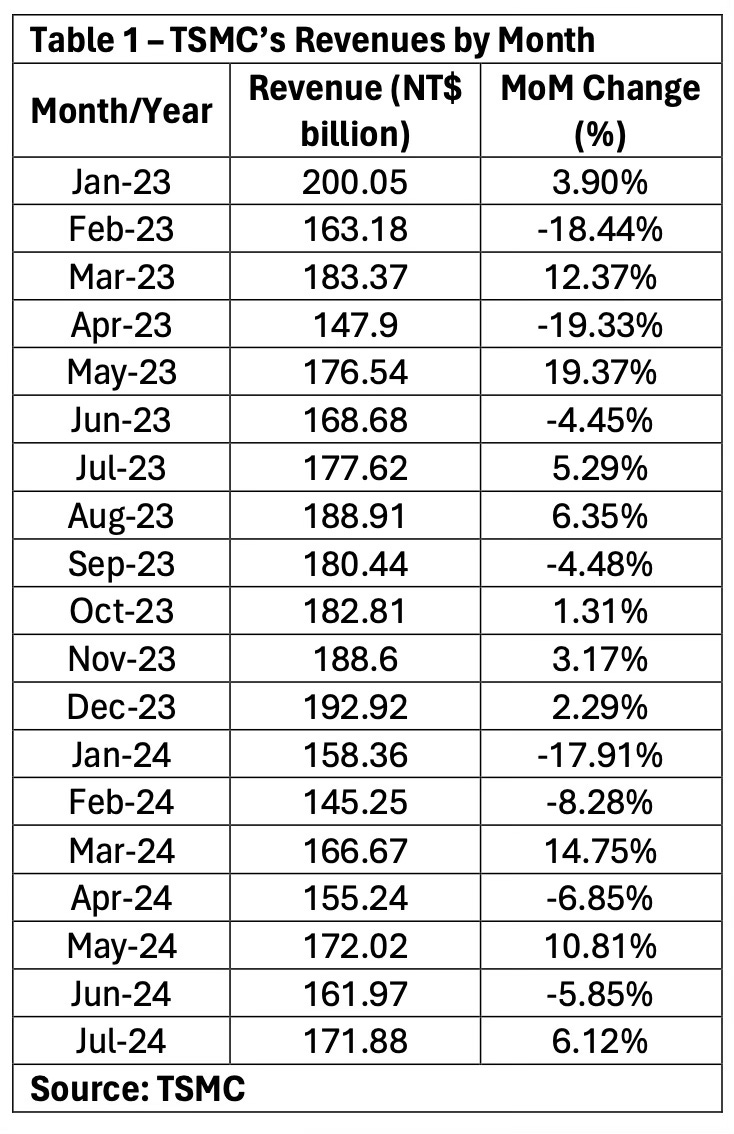

TSMC’s Revenue

TSMC's revenue in July soared by 44.7% year-over-year, reaching approximately NT$256.95 billion, driven by increasing demand for AI chips used in artificial intelligence products.

As a key supplier to major tech giants like Apple, Nvidia, and AMD, TSMC also experienced a 23.6% rise in revenue compared to the previous month, with June's revenue totaling NT$207.87 billion.

For the first seven months of 2024, TSMC's revenue reached NT$1.523 trillion, marking a significant 30.5% increase compared to the same period in 2023.

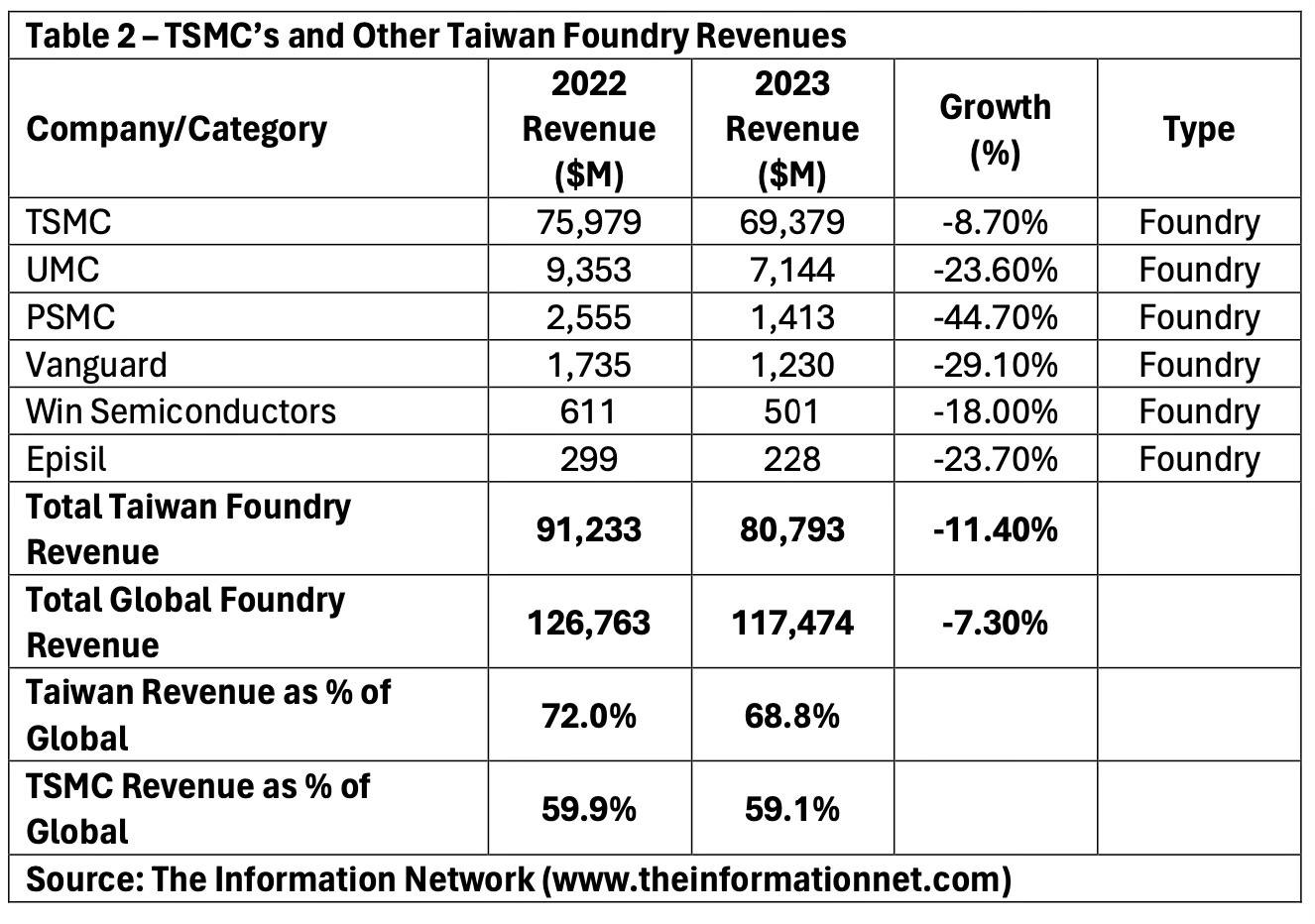

Taiwan’s TSMC is further solidifying its dominance in the semiconductor foundry sector as demand for AI chips continues to surge. Renowned for its high yields and advanced packaging capabilities, TSMC is capturing an increasing share of orders.

Shown in Table 2 are Taiwanese foundries and their revenues.