Tesla’s Robotaxi Platform Could Drive Long-Term AI Dominance

Tesla, Inc. dominates the EV market, but artificial intelligence—not batteries—will determine its leadership in the next wave of automotive innovation: autonomous mobility. On April 5, 2025, Elon Musk confirmed that Tesla will unveil its dedicated Robotaxi vehicle on August 8, representing not just a new product but a foundational leap in the company’s AI-first strategy. The Robotaxi represents a capstone to years of investment in neural networks, Dojo supercomputing, vision-based perception systems, and vehicle integration. While competitors continue relying on high-cost LiDAR sensors and modular vehicle designs, Tesla’s purpose-built Robotaxi system, trained on billions of driving miles, aims to scale autonomous driving for the mass market.

This article updates my August 23, 2024 analysis of Tesla’s Robotaxi positioning in light of April 2025 developments, and compares Tesla’s architecture, cost structure, and scalability to competitors like Waymo, Cruise, Zoox, Baidu, and Motional entitled “Tesla: Brilliant AI-Driven Robotaxi Model, But Not Today.”

Tesla's Market Share Foundation in EVs

Tesla's leadership in EVs over the past decade serves as the financial and operational foundation for its Robotaxi initiative. Between 2010 and 2012, Tesla held a negligible EV market share as it launched the Roadster and early Model S vehicles. The situation changed significantly from 2013 to 2017 as the Model S and Model X gained traction, followed by explosive growth after the Model 3’s debut in 2018. These milestones built Tesla’s brand equity, supply chain strength, and cash flow—critical enablers for its entry into autonomous ride-hailing.

Table 1 shows Tesla’s global EV market share trajectory across major phases of product scaling, based on The Information Network’s market data, according to my repot “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts.”

This historical EV dominance underpins Tesla’s next wave of growth, not in hardware, but in software—specifically, AI-driven autonomy.

FSD Strategy: Tesla’s Break from LiDAR-Based Systems

The key differentiator between Tesla and its Robotaxi competitors is its rejection of LiDAR in favor of a vision-based system driven by AI and neural networks. While most AV developers utilize LiDAR—a laser-based system capable of mapping high-resolution 3D environments—Tesla uses a combination of cameras, radar (in some models), and its proprietary Full Self-Driving (FSD) computer. Tesla’s bet is that neural networks trained on vision, not laser scanning, will ultimately lead to safer, more scalable autonomy.

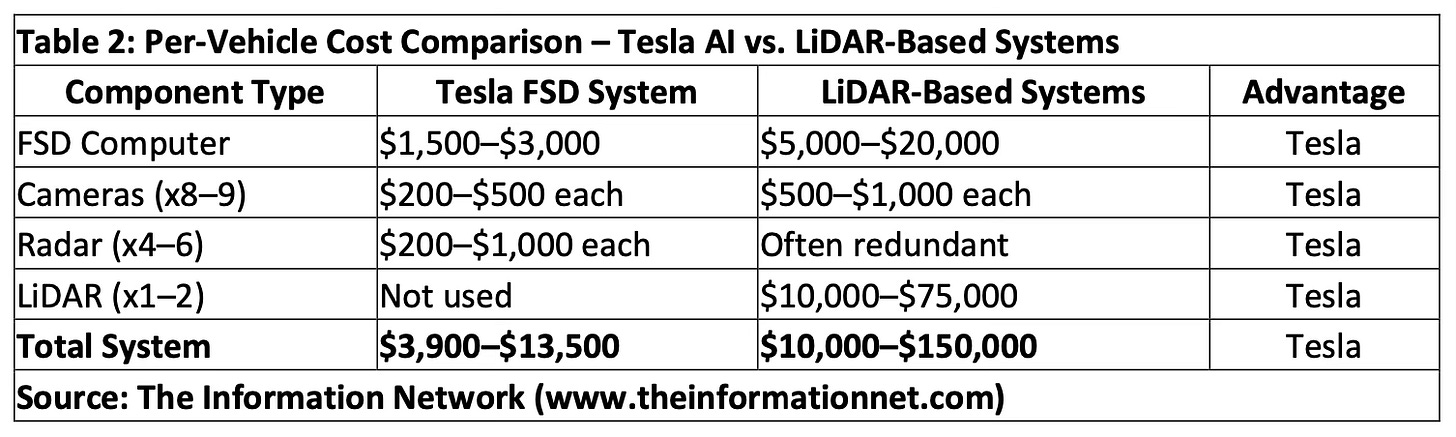

Table 2 presents a comparative breakdown of per-vehicle costs between Tesla's AI-based system and LiDAR-based systems. It also captures why Tesla’s approach could unlock margin and scale advantages over time.

Note: New solid-state LiDARs manufactured in China have dropped to as low as $200–$500 per unit in 2025, though total system cost remains significantly higher when multiple units and software integration are included.

Tesla’s hardware remains cost-competitive compared to LiDAR-based stacks, though the cost advantage has narrowed in markets like China, where suppliers now offer solid-state automotive LiDARs for as little as $200. However, scaling these cheaper LiDAR systems into full AV stacks still involves multi-sensor integration, pushing the system cost well above $1,000 in most commercial vehicles.

Training Infrastructure: High Upfront Cost, High Strategic Leverage

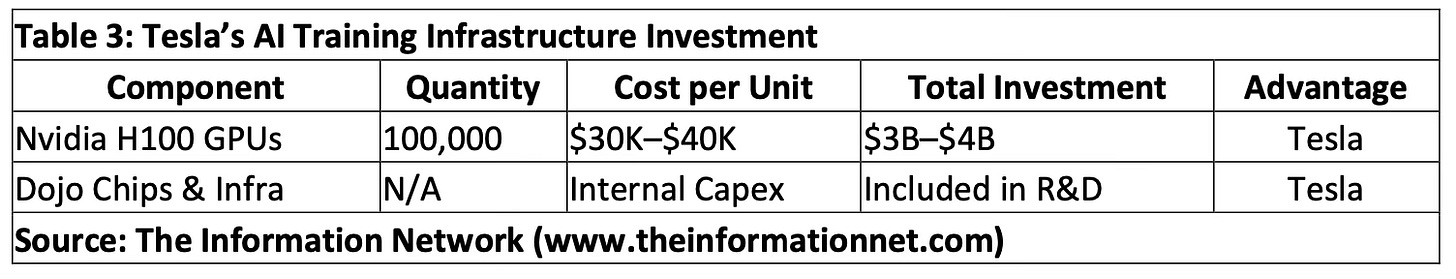

One key reason Tesla can reject LiDAR is its immense investment in AI training infrastructure. Tesla leverages Nvidia's H100 chips and its internally developed Dojo supercomputer to train neural nets on vast quantities of real-world driving data. In 2024, Tesla reportedly acquired 100,000 H100 chips, representing one of the largest private investments in AI compute in the world.

Table 3 estimates the total investment Tesla has made into its AI training architecture, comparing it to more modular and less compute-intensive approaches by LiDAR-based competitors.

While these costs are high, they represent fixed investments that amortize across every mile Tesla trains, every vehicle it sells, and every Robotaxi it deploys.

Fleet Deployment Cost: Tesla's Economic Edge

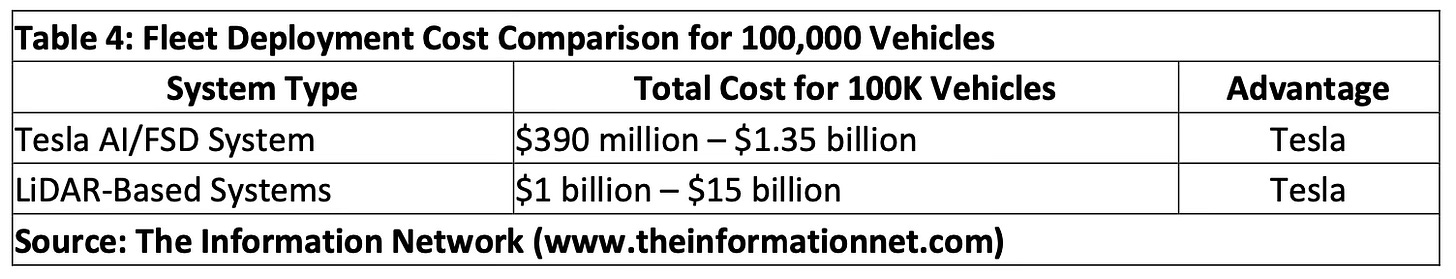

As Robotaxi programs transition from R&D to deployment, fleet cost becomes a critical metric. Tesla’s simplified sensor suite provides major cost advantages when scaled to tens or hundreds of thousands of vehicles. Table 4 illustrates this point clearly: outfitting 100,000 Robotaxis with Tesla’s AI system costs under $1.5 billion, compared to a potential $15 billion for equivalent LiDAR-based fleets.

This cost advantage is particularly critical when Robotaxi fleets need to scale across dozens of cities. Tesla’s approach supports affordability, density, and redundancy.