The Hidden Slowdown: Why the Semiconductor Equipment Market Faces Two Consecutive Years of Decline

Semiconductor industry revenues are growing over 20%, but unit shipments are flat, signaling challenges for sustainable growth.

Memory revenues for NAND and DRAM are surging by up to 90%, yet unit shipments are stagnant or declining, with growth concentrated in high-value AI applications.

China’s expected drop in semiconductor equipment demand in 2025 removes a key growth driver, deepening the anticipated market downturn.

Two consecutive years of negative growth are likely for the WFE market as flat wafer demand and stagnant unit shipments impact the industry.

Introduction

The semiconductor industry has long been associated with rapid growth and relentless technological advancement. However, my newest analysis reveals a more nuanced story. While semiconductor revenue growth may appear robust, underlying indicators suggest that the industry is grappling with stagnation in unit shipments and weakening demand in critical segments. This discrepancy between revenue growth and unit volume underscores a potential slowdown in the semiconductor equipment market over the next two years. Leveraging key data on global semiconductor revenues, NAND and DRAM market trends, and the latest wafer shipment forecasts, this article delves into why the Wafer Front End (WFE) equipment sector is poised for contraction in both 2024 and 2025. Data for this article came from my report Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts available through The Information Network

A Revenue-Driven Illusion of Growth

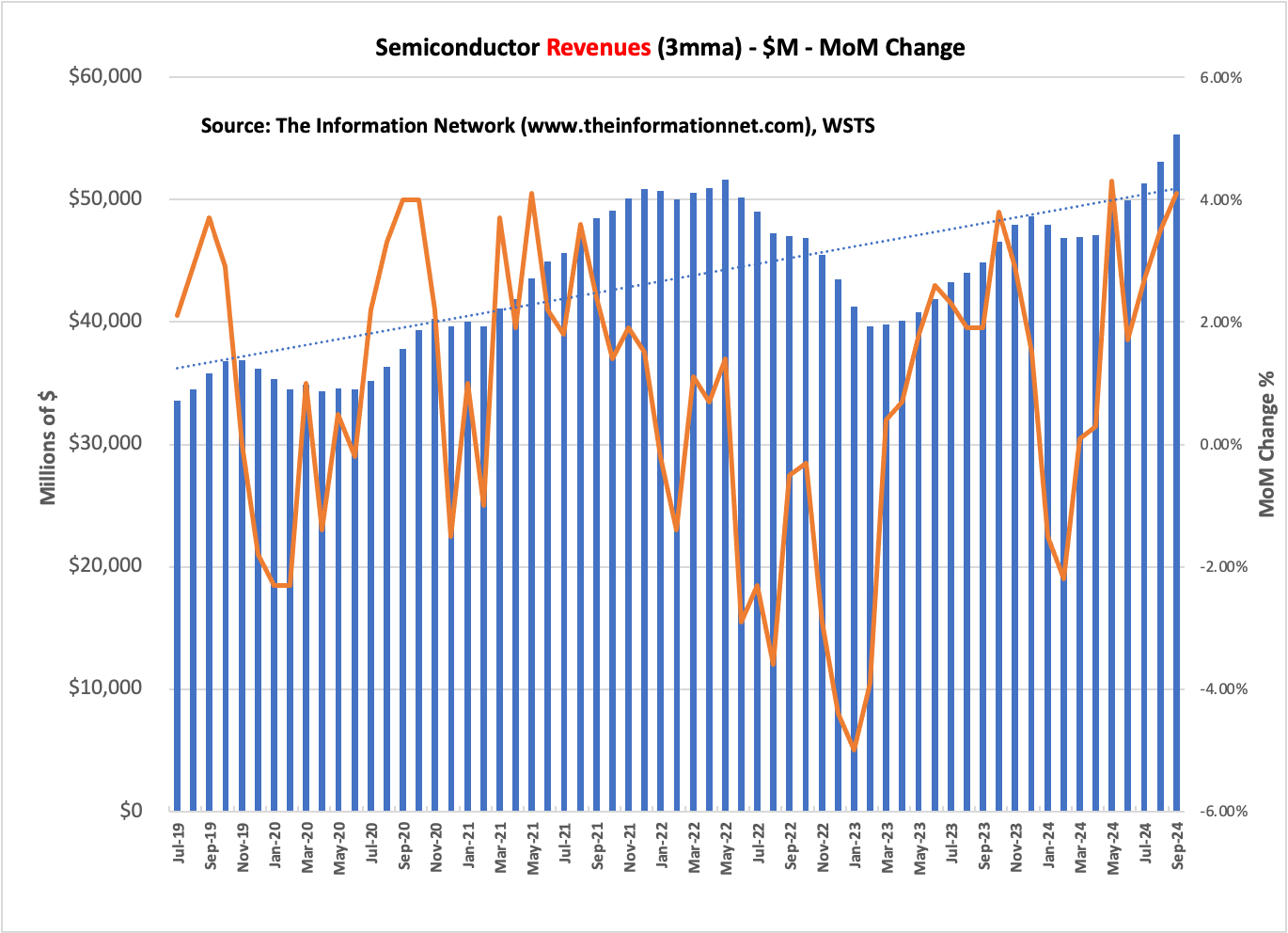

At first glance, the semiconductor industry seems to be thriving, with projected revenue growth exceeding 20% year-over-year, as shown in Chart 1.

Chart 1

Revenue for the January-September 2024 period is up 19% over the same period in 2023.

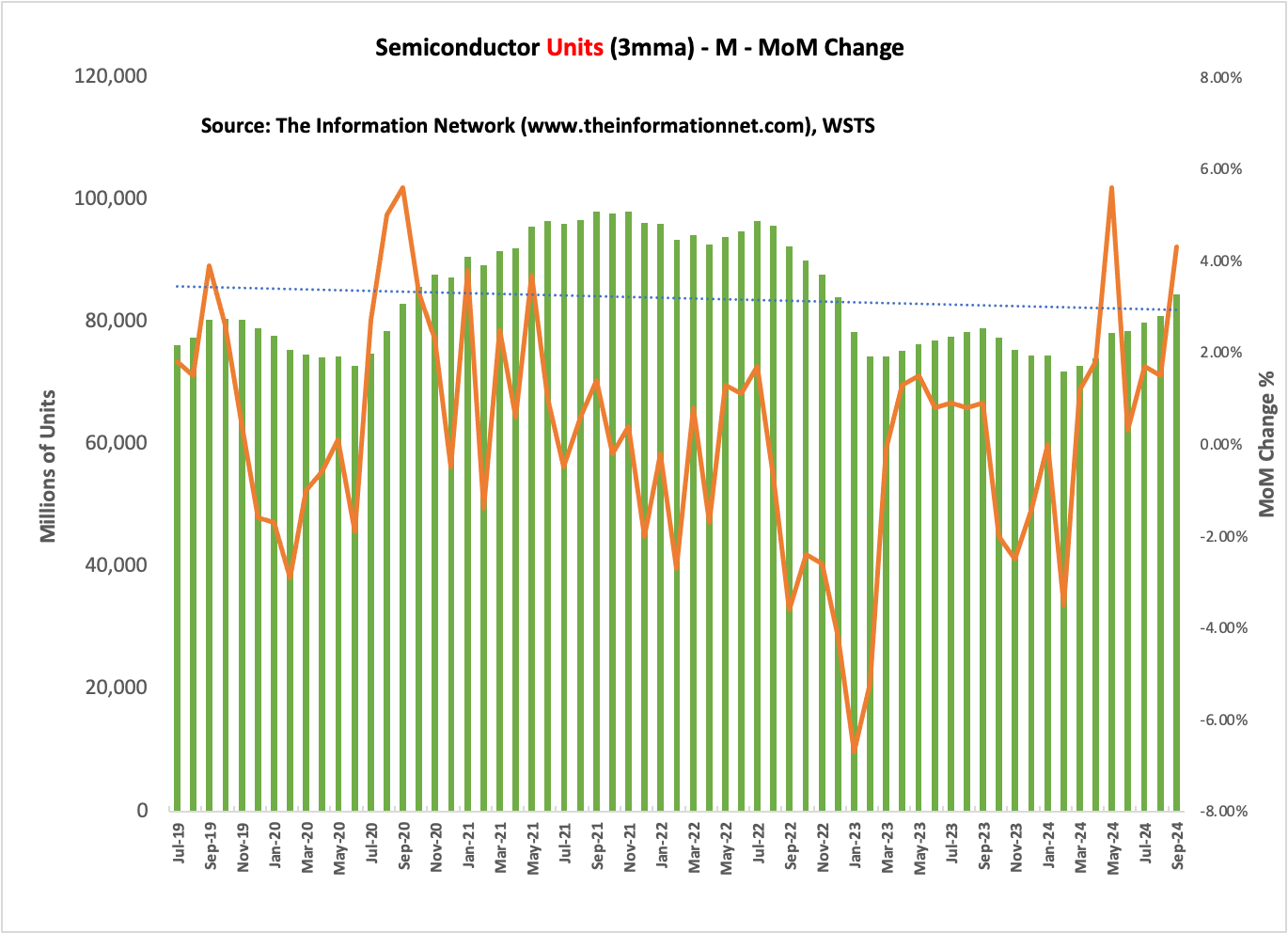

Yet, this growth masks a critical reality: unit shipments are flat, as shown in Chart 2.

Chart 2

Unit shipments for the January-September 2024 period is up just 0.7% over the same period in 2023.

This discrepancy suggests that while prices and demand for advanced technologies are pushing revenues up, actual production volumes are not keeping pace. Such a trend is problematic for the equipment suppliers who rely on high unit volumes to drive demand for new manufacturing capabilities.

Flat unit shipments amid rising revenues imply that companies are focusing more on high-value products, likely at advanced nodes. However, this demand for cutting-edge technology does not translate to broad-based equipment sales growth, especially for mature nodes and legacy equipment. Consequently, WFE sales are expected to decline as the industry adapts to a period of recalibrated growth.

SEMI is Wrong about Equipment for Memory Chips

While the foundry and logic segments face challenges, the memory market tells a different story. According to forecasts from SEMI, the Equipment Industry Consortium, memory-related capital expenditures are set to increase significantly, with NAND and DRAM equipment sales on an upward trajectory. However, my analysis shows that while memory growth is strong, equipment is also flat as in the overall semiconductor industry.

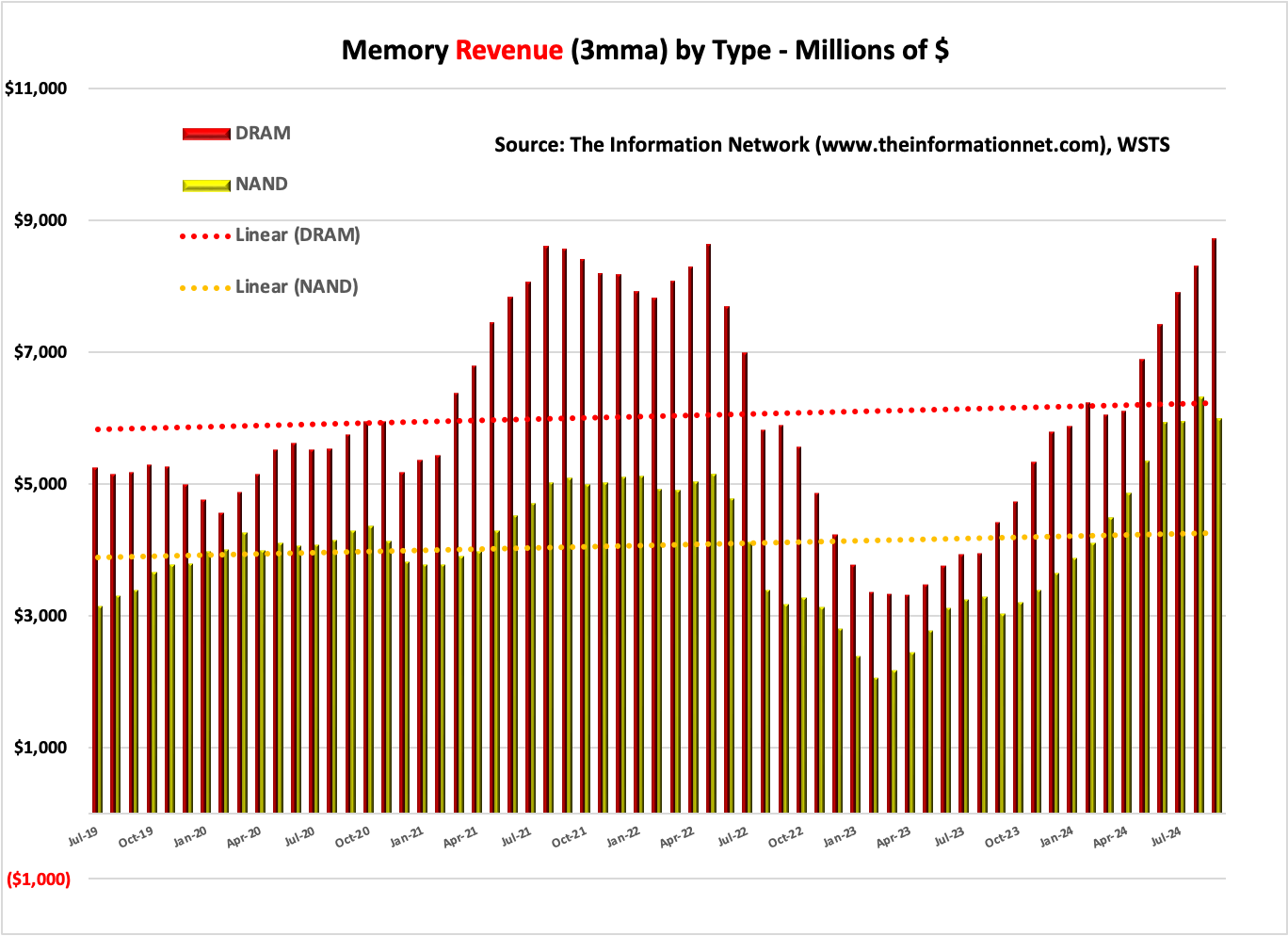

Data indicates that memory revenues are experiencing a strong surge, with NAND and DRAM projected to grow by as much as 90%. This growth is largely driven by high-bandwidth memory (HBM) and other technologies critical for AI applications, as shown in Chart 3.

Chart 3

Revenue for the January-September 2024 period is up 90% over the same period for both NAND and DRAM in 2023.

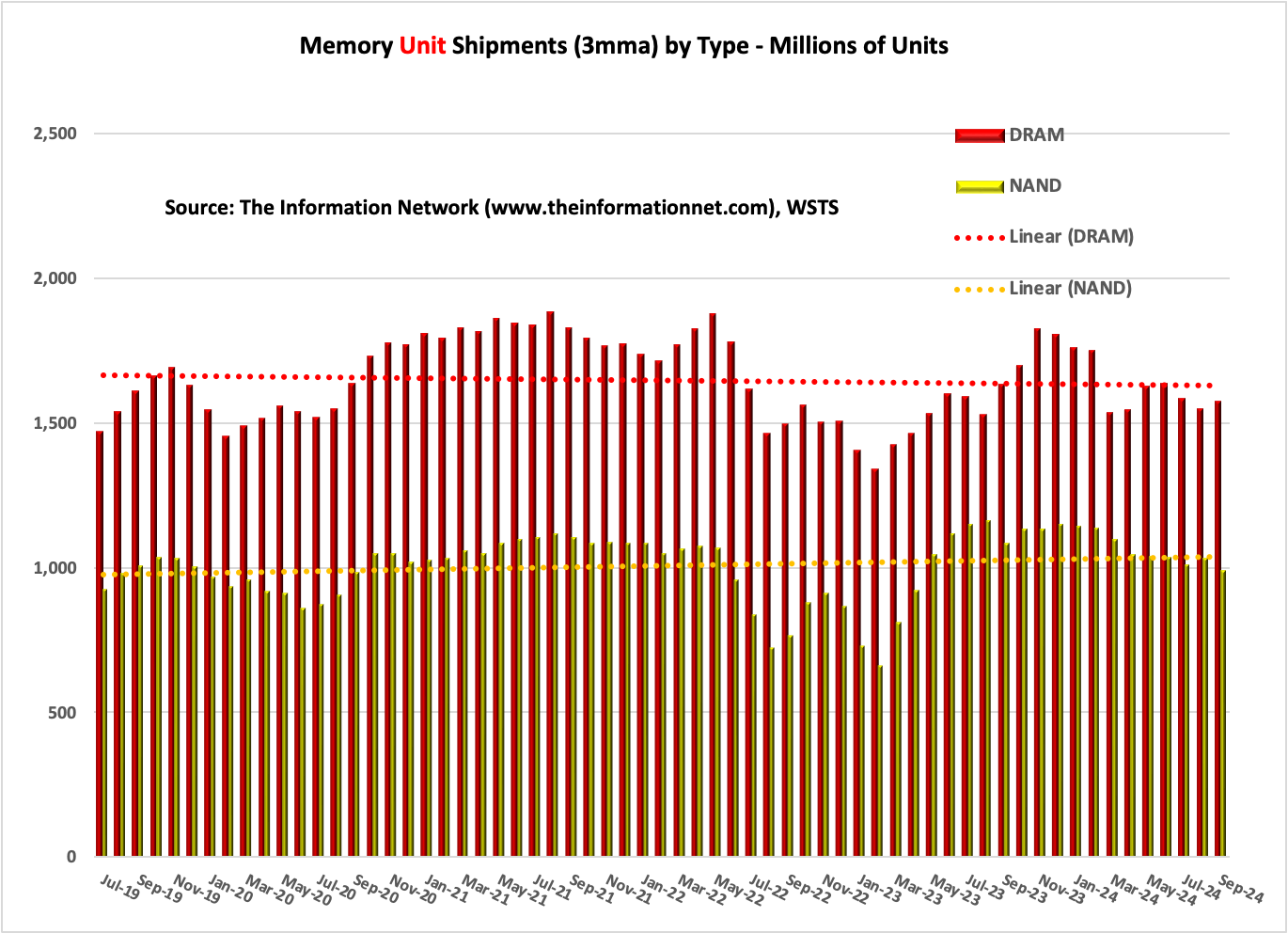

Yet, despite these revenue gains, unit shipments paint a more sobering picture. DRAM units are down year-over-year, while NAND units remain flat as shown in Chart 4. This trend suggests that the market's focus is on high-value memory solutions rather than increased production volumes. As a result, the memory segment's revenue growth does not necessarily equate to expanded demand for WFE across the board.

Chart 4

The growth in memory revenues is therefore likely to be concentrated in equipment for specific applications, rather than a broad-based increase in WFE spending. This nuance is essential for understanding why, despite skyrocketing memory revenues, overall WFE growth remains subdued.

Silicon Wafer Growth

The latest forecast from SEMI for global wafer shipments provides additional context for the expected slowdown in the WFE market. SEMI anticipates a 2% decline in wafer shipments in 2024, a reflection of flat unit demand across the semiconductor industry. This decline in wafer demand correlates with the observed flat unit shipments for NAND and DRAM and the modest contraction in foundry and logic equipment spending.

Wafer demand serves as a critical barometer for the health of the semiconductor equipment market, and the projected decline suggests that demand is failing to keep pace with revenue growth. Given that wafer shipments are fundamental to semiconductor production, a drop in this area signals broader industry challenges that are likely to dampen WFE growth in 2024 and beyond.

The Impact of Intel's Setback on WFE Spending

Intel’s recent financial troubles highlight the challenges faced by the industry’s key players. The company’s disappointing quarterly results, compounded by a significant drop in its WFE spending, underscore broader issues within the semiconductor market. Intel, a major driver of foundry and logic WFE investments, is pulling back on its capital expenditures, thereby reducing demand for equipment in these segments. I discussed this issue at length in a September 5, 2024 Substack article entitled Applied Materials Hit Hard Financially as Intel's Largest Supplier.

China’s Market Contraction and the 2025 Outlook

Another factor that compounds the challenges facing the semiconductor equipment industry is the projected downturn in China’s market in 2025. China has been a key driver of WFE demand, particularly as it seeks to bolster its domestic semiconductor production capabilities. However, recent data suggests that China’s demand for semiconductor equipment may decrease next year, driven by a combination of economic pressures and trade restrictions.

With equipment sales to China projected to decline, a significant source of WFE growth will be absent in 2025. This reduction is expected to contribute to an overall downturn in the semiconductor equipment market, exacerbating the anticipated contraction in foundry and logic segments and tempering growth in the memory sector.

I discussed my analysis for the WFE downturn due to China in my October 21, 2024 Substack article entitled ASML: Walking a Tight Rope on China, Intel, and Samsung Says The Information Network.

The Basis for a Two-Year WFE Downturn

Based on these converging factors, the semiconductor equipment industry appears poised for two consecutive years of negative growth. In 2024, foundry and logic equipment sales are expected to contract as demand for mature nodes wanes and companies like Intel reduce their WFE spending. While memory-related expenditures are projected to rise, the growth is likely to be limited to specific applications, such as high-bandwidth memory for AI, rather than a broad-based increase in equipment demand.

The outlook for 2025 is similarly cautious. While there may be a rebound in certain areas, the overall market dynamics suggest that growth will remain subdued. China’s anticipated downturn in semiconductor equipment demand will likely compound the challenges faced by global WFE suppliers, reinforcing a forecast of two years of negative growth for the industry.

Conclusion: Navigating the Coming Downturn

The semiconductor industry’s current growth dynamics reveal a complex landscape, where revenue increases do not necessarily translate into robust demand for equipment. With flat unit shipments and reduced wafer demand, the WFE market is positioned for a challenging period ahead. Intel’s setback, the bifurcation of growth in the memory segment, and China’s projected contraction all suggest that the next two years will be marked by negative growth in the WFE sector.

In this environment, equipment manufacturers and suppliers must adapt to a new reality, where growth is increasingly selective and driven by high-value applications rather than broad-based demand. As the industry enters this period of adjustment, stakeholders will need to recalibrate their strategies to align with a more targeted, application-driven growth model. With the right focus on innovation and efficiency, the semiconductor equipment sector can weather this slowdown and emerge stronger, prepared to support the next wave of industry transformation.

Authors note: This full article is being sent to readers and free subscribers, as well as Paid Subscribers. It illustrates what readers are missing by not being a Paid Subscriber because I initiate a Paywall after the first chart. Sign Up Now.

Is the Tier 1 top 10 OEM constant or is anyone taking or losing market shares?