Trump 2.0 Tariffs: Will They Reshape the Semiconductor Industry?

Concerns are mounting as President-elect Donald Trump’s rhetoric on tariffs sparks uncertainty about future U.S.-China trade relations.

Trump’s first-term tariffs were maintained under Biden, who added $18 billion in new tariffs in 2024 targeting critical technologies.

Semiconductor and high-tech sanctions, initiated under Trump, were expanded under Biden to include advanced technologies and stricter conditions for Chips Act beneficiaries.

To begin with, I’d like to thank Simon Woo, a Research Analyst at BofA Global Research in Korea on Asia Tech & Global Memory, for inviting me to present my thoughts the semiconductor industry including AI and packaging on Monday night (Nov 11). The 1-hour presentation over Zoom started with my thoughts on the impact of the Trump win, particularly on tariffs and the Chips Act. I was told a summary was published on the BofA website on November 12.

The U.S. election's prominence as the opening topic highlights the importance of this issue to BofA analysts and clients. I devoted considerable effort to researching the history of sanctions and tariffs in the U.S. and their effects on the U.S. consumer. I also contrasted Trump’s 2017–2018 policies, pre-COVID, with Biden’s policies in 2023–2024, after the pandemic.

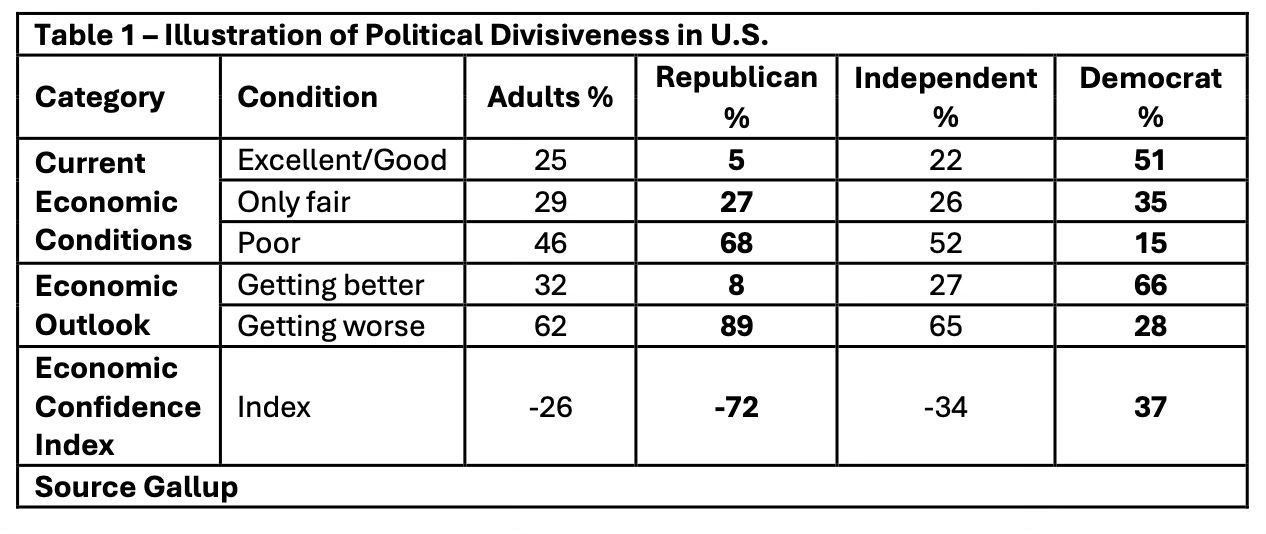

This article addresses these topics from an independent perspective and encourages readers to critically evaluate the sources of the information they consume. For instance, Table 1 illustrates the divisiveness in U.S. economic perceptions along political lines. Gallup data shows that, as of October 2024, 51% of Democrats rated the economy as Excellent/Good compared to just 5% of Republicans. Conversely, 68% of Republicans rated it Poor, compared to 15% of Democrats.

Comparison of Semiconductor/Technology Sanctions on China

I’ve written extensively that U.S. sanctions on China were not working, and merely served to accelerate Chinese localization of its semiconductor equipment industry. In other words, Chinese equipment companies grew at the expense of non-Chinese companies.

Chart 1, which comes from my report Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts, which can be seen on my website at The Information Network. It shows on the left that in 2023, revenues of Chinese equipment companies had a mean growth of 43.4% YoY while non-Chinese companies such as Applied Materials (AMAT) had a growth of -0.6%.

For the first half of 2024, the trend continued.