TSMC Raising Prices 5% In 2025 As Revenue Growth Underperforms Customers

TSMC is a semiconductor foundry that manufactures chips for companies like AMD and Nvidia.

TSMC's revenue and share price are underperforming compared to AMD and Nvidia.

TSMC is increasing prices of its chips an aggregate of 5% in 2025 compared to 2024 prices.

Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) is a global leader in the semiconductor foundry space, specializing in chip manufacturing for fabless companies like Advanced Micro Devices, Inc. (AMD) and Nvidia Corporation (NVDA). While AMD and Nvidia focus on chip design and sales, TSMC's business model is rooted in providing advanced manufacturing services. This enables its clients to innovate without the substantial costs associated with owning and updating fabrication plants, which TSMC manages with a relentless focus on technology scaling and process innovation.

TSMC’s revenue model is driven by the diverse array of customers it serves. Although high-profile clients like AMD and Nvidia are integral to TSMC’s revenue stream, other variables also influence the company's performance, including global semiconductor market demand, TSMC's production capabilities, and its competitive position within advanced technology nodes. This structure creates unique dynamics: while TSMC’s financials are tied to its clients, its revenue trends don’t necessarily mirror those of individual customers, as industry cycles, technology shifts, and supply chain dynamics all play significant roles.

Impact of Market Cycles on TSMC’s Revenue

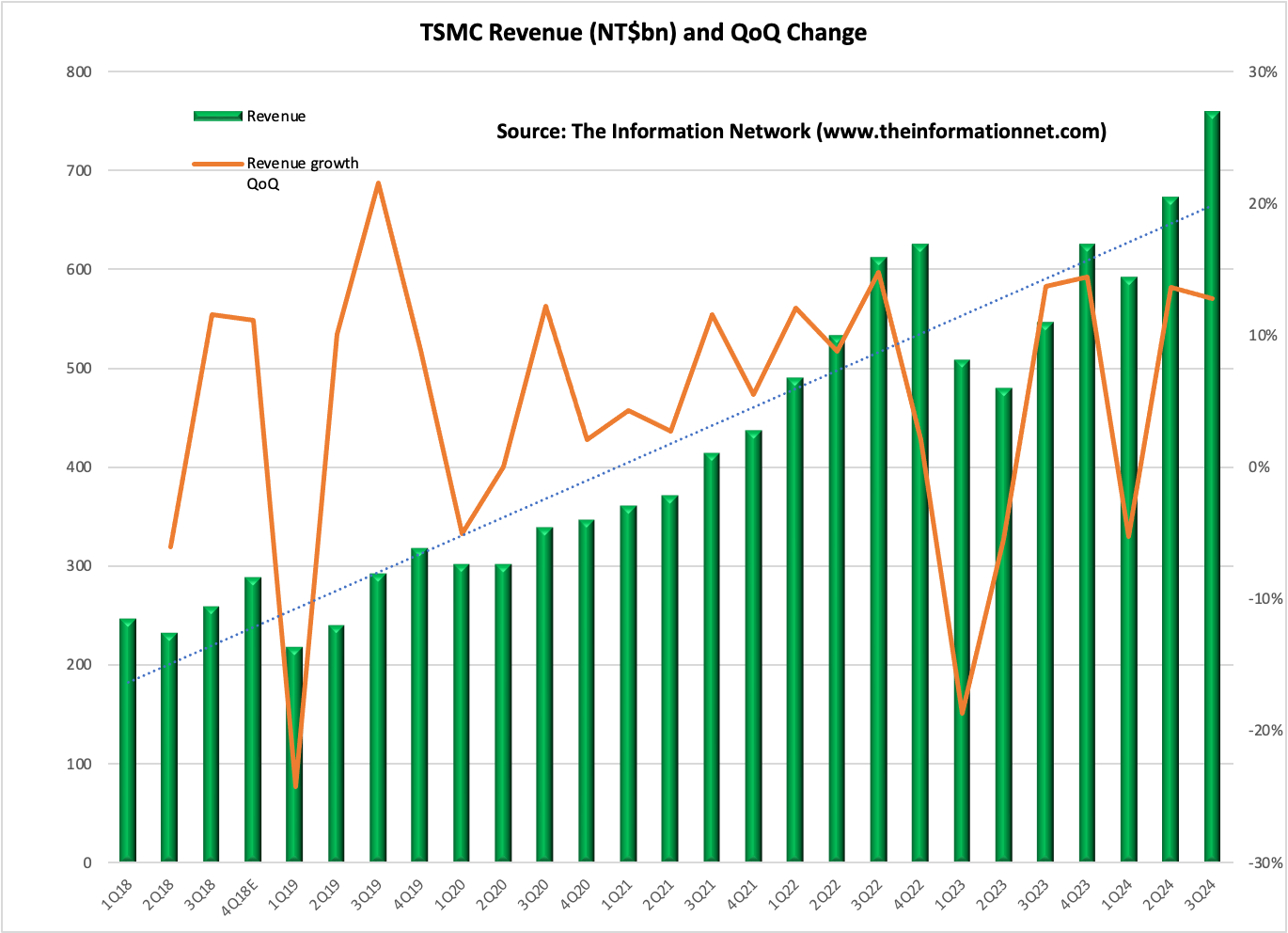

The semiconductor industry operates in cycles influenced by consumer demand, innovation, and macroeconomic factors. In 2023, TSMC experienced a year-over-year revenue drop of 4.4% in the first half due to a downturn in the consumer electronics market. This market weakness affected the entire semiconductor sector, particularly impacting memory chip makers like Micron Technology, Inc. (MU) and Samsung Electronics Co., Ltd. (OTCPK: SSNLF). Nevertheless, TSMC’s strategic focus on advanced technology nodes allowed it to post an 18.5% recovery in the second half, highlighting the resilience of its business model amid cyclical challenges.

Chart 1 captures TSMC's total quarterly revenue (NT$ billion) for TSMC between from Q1 2018 through Q3 2024, alongside quarter-over-quarter growth rates, according to The Information Network's report Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts. This trend in smaller nodes underscores TSMC’s pivotal role in meeting the rising needs of data centers and AI-driven applications, where advanced chip capabilities are critical.

Chart 1

Chart 2 captures TSMC's shipments by technology from Q1 2018 through Q3 2024,