TSMC’s Expansion Gamble: Advanced Nodes, U.S. Fabs, and the Next Phase of Foundry Dominance

Introduction

The semiconductor industry has long been defined by bold bets. For Taiwan Semiconductor Manufacturing Company (TSMC), the bet today is whether its unprecedented expansion in advanced nodes and overseas fabs will secure its dominance in the next era of chipmaking. The numbers are staggering: capex above $40 billion, capacity plans stretching across continents, and customer commitments spanning AI, smartphones, PCs, and hyperscaler ASICs. Yet behind the headlines lies a deeper story — one of capital intensity, geopolitical insurance, and the strategic pivot to advanced nodes that now account for the majority of its revenues.

The following analysis dissects TSMC’s transition, comparing its capacity, technology roadmap, customer pipeline, and competitive position against peers. For investors, the question is not whether TSMC will grow — but whether the costs, risks, and external pressures reshape the economics of this growth.

The Shift to Advanced Nodes

TSMC’s revenue composition has dramatically transformed in the last seven years. Advanced nodes — defined as 7nm and below — once accounted for less than 10% of revenues, but now represent nearly 70% of the company’s topline. The progression from 7nm to 5nm and now to 3nm has been relentless, with 2nm on track for volume production in the second half of 2025. Data for this article came from my Technical-Marketing report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

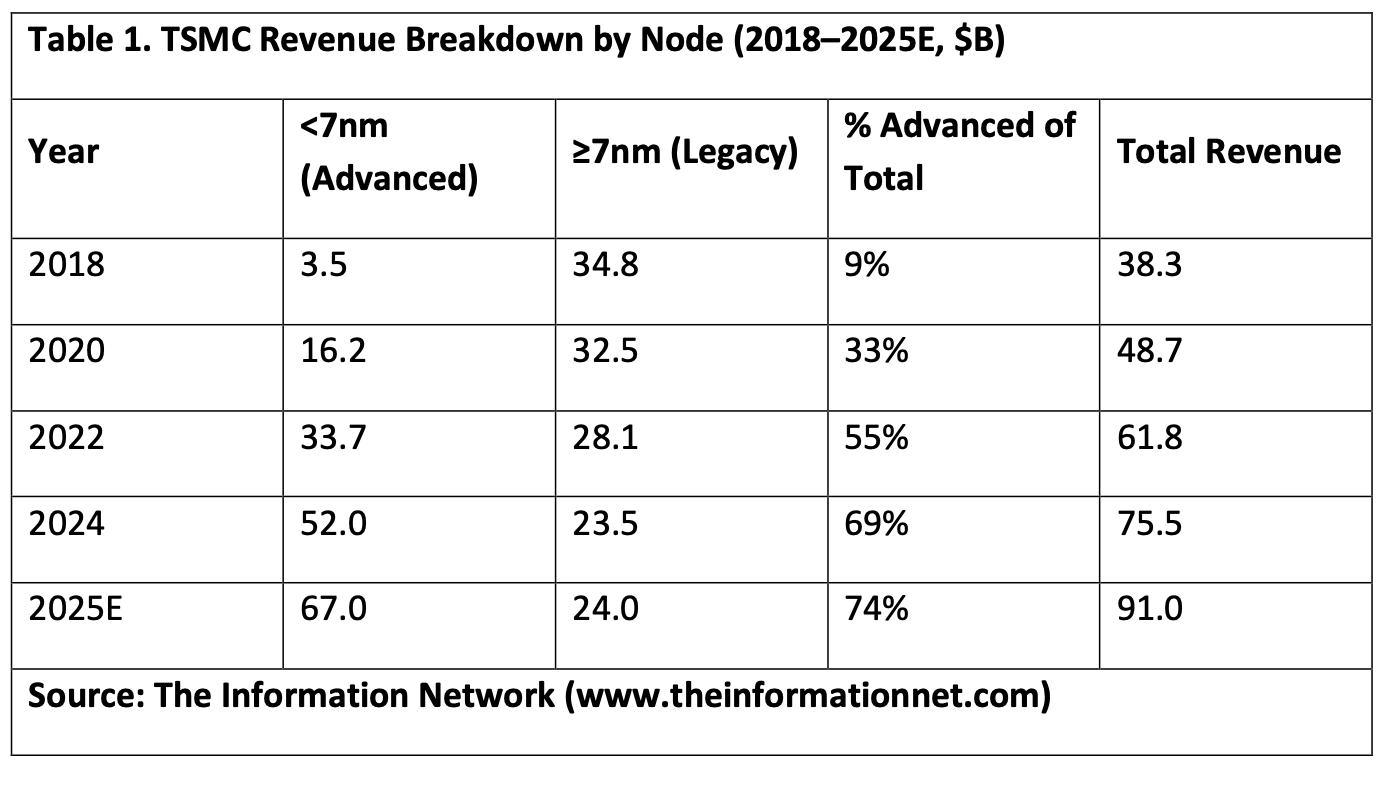

Table 1 shows that advanced node revenues have expanded at an average growth rate above 60% annually, while legacy nodes have stagnated or declined. This divergence explains why TSMC’s capital allocation is overwhelmingly focused on EUV-intensive processes, which not only command higher ASPs but also reinforce customer dependence.

According to Chart 1, TSMC’s revenue breakdown highlights a decisive pivot toward advanced nodes. In 2018, they represented less than 10% of the topline, but by 2025 they are expected to reach nearly three-quarters of all revenues. The steady decline of legacy processes underscores the company’s willingness to sunset older nodes in favor of high-margin EUV-based production.

Chart 1