TSMC's Resilience in Mature Nodes: Debunking the SMIC Price War Narrative

Recent claims that China’s Semiconductor Manufacturing International Corp.’s (SMIC) aggressive pricing on 28nm chips is reshaping the competitive landscape overlook the broader realities of the semiconductor industry. SMIC’s decision to reduce the price of its 28nm wafers from $2,500 to $1,500 has been framed as a bold move to erode Taiwan Semiconductor Manufacturing Corp.’s (TSMC) (TSM) market share in the mature node segment. However, a deeper analysis reveals that TSMC’s leadership remains unshaken. With its superior technology, trusted customer relationships, and efficient operations, TSMC continues to dominate in a market that prioritizes reliability and performance over price alone.

I’ve written extensively about TSMC and its pricing, and my report at The Information Network entitled Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts, details TSMC’s revenue by node by year between 1995 and 2027.

My latest article (March 5, 2024) on TSMC prices Taiwan Semiconductor Raising Prices 8.7% In 2024 As Revenue Growth Underperforms Customers discussed the fact that TSMC is raising prices in 2024, undeterred by SMIC’s claims of gaining customers.

I’ve written extensively about SMIC as well, and in a May 18, 2022 article entitled Applied Materials: SMIC Move To 7nm Node Capability Another Headwind, first alerted readers that SMIC had reached the 7nm node without EUV lithography.

SMIC’s pricing approach targets cost-sensitive customers and aims to establish a foothold in the mature node segment. However, the semiconductor industry is complex, with success contingent on much more than low pricing. For TSMC, mature nodes like 28nm are more than just a revenue stream; they underpin the company’s ability to invest in advanced nodes, where technological leadership drives the broader industry. Despite SMIC’s aggressive moves, TSMC’s combination of higher ASPs, superior profit margins, and customer loyalty ensures its continued dominance in this crucial segment.

Quarterly Revenue Trends

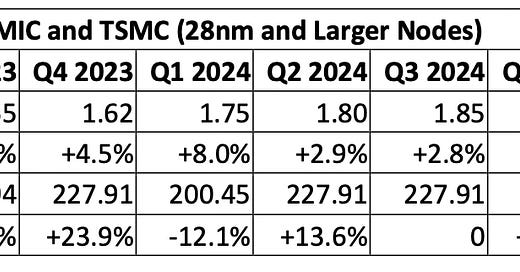

To assess the impact of SMIC’s price cuts, we must examine the revenue performance of both SMIC and TSMC in the 28nm and larger node segment. The data reveals that SMIC’s steady growth pales in comparison to TSMC’s significantly higher revenues, which reflect the latter’s ability to deliver value and command premium pricing.

Table 1 highlights the quarterly revenues and quarter-over-quarter (QoQ) changes for SMIC and TSMC in the 28nm and larger node segment over the past two years. It showcases SMIC’s steady growth trajectory alongside TSMC’s far larger revenue figures, emphasizing TSMC’s leadership in this market segment despite SMIC’s aggressive pricing.