U.S. DoD Choice To Reward Failed Intel Illustrates the Pathetic State of U.S. Semiconductor Manufacturing

Welcome new Sell-Side Analysts to my newsletter. I write exclusively for Substack and no longer with Seeking Alpha. If you were a Paid Subscriber to my Semiconductor Deep Dive Newsletter on Seeking Alpha, it continues on Substack.

Summary

Despite Intel’s recent struggles, the U.S. Department of Defense has awarded $3.5 billion to Intel for classified semiconductor work.

Intel’s selection highlights the lack of viable U.S. options for advanced semiconductor production.

The DoD’s decision underscores the dire state of U.S. semiconductor manufacturing, with Intel chosen due to lack of domestic alternatives.

The Secure Enclave initiative aims to provide cutting-edge semiconductor capabilities specifically for national defense.

According to a November 6, 2023 article in the Wall Street Journal, Intel (INTC) was the leading candidate to potentially receive billions of dollars in government funding for secure facilities producing microchips for U.S. military and intelligence applications.

Now, Intel has reportedly entered into a significant agreement under the U.S. Department of Defense’s "Secure Enclave" initiative, which aims to bolster domestic production of advanced semiconductors crucial for national defense. As part of this initiative, Intel is expected to receive around $3.5 billion in federal support to enhance its semiconductor manufacturing capabilities.

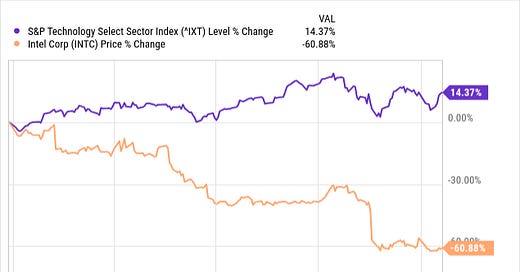

Despite these efforts, Intel has faced serious financial challenges, with its stock losing roughly one-third of its value following wider-than-anticipated losses and large-scale layoffs announced after its recent earnings release. Since the beginning of 2024, the company's stock has plummeted by almost two-thirds, reflecting growing concerns among investors. Chart 1 show Intel’s YTD share price performance compared to the S&P (^IXT).

To navigate these hurdles, Intel is said to be exploring a variety of strategies to streamline its operations and improve financial performance. These include potentially divesting its foundry business, selling its Altera division, and reducing its stake in MobileEye (MBLY) after having already scaled back its holding in chipmaker Arm (ARM). In addition, Reuters reported that recent tests of Intel's latest manufacturing process conducted by Broadcom failed.

Additionally, Intel's ability to capitalize on approximately $20 billion in incentives from the CHIPS Act may be at risk. The release of these funds is contingent upon the company meeting specific milestones, and Intel has not yet received any of the funding, with further details reportedly being requested about its production roadmap.

Intel's Gelsinger Has Failed To Turn A Sow's Ear Into A Silk Purse

I discussed Intel’s failures in my August 17, 2024 Substack Article entitled “Intel's Gelsinger Has Failed To Turn A Sow's Ear Into A Silk Purse,” Where I noted:

Intel had previously struggled with manufacturing its 14nm and 10nm chips, leading to reliance on TSMC for production, and impacting market share.

Intel-made processors have been limited to its Intel 4 process, previously known as Intel’s 7nm node.

Recent Intel processors, such as Raptor Lake, have experienced stability issues in gaming and server environments due to high power consumption.

Intel's AI processors, such as Gaudi 3, show competitive pricing and performance compared to Nvidia's processors.

My analysis of Intel and its failed attempts to compete with TSMC (TSM) and Samsung Electronics (SSNLF) go back to 2021 in my article April 27, 2021 article entitled “Intel: Making Chips For Others It Can't Make For Itself,” I noted that:

“Intel has not been able to make a 7nm chip, deferring production of its CPUs to TSMC and Samsung Electronics. In fact, TSMC produces chips for Intel rivals, and that's helped Advanced Micro Devices (AMD) steal share in the crucial PC and data center markets.”

Readers can learn the history of these failures over the past 10 years and how they continue today.

Why Would the DoD Choose Intel Amidst All its Failings?

The U.S. Defense Department has discreetly redirected $3.5 billion from the Commerce Department’s CHIPS Act to fund Intel's development of a classified semiconductor manufacturing facility known as "Secure Enclave."

Proponents of the project argued that the existing Trusted Foundry program, established in 2004 to certify commercial semiconductor manufacturing for defense, was insufficient for advanced chips. Trusted foundries are two generations behind what is available on the commercial state-of-the-art market.

The Secure Enclave initiative aims to provide a higher level of security for cutting-edge semiconductor production to meet specific defense-related needs. Intel has an established EUV lithography program and is installing even more advanced High NA EUV systems. According to Intel:

“Advanced nodes are also helping the military drive its missions by improving size, weight, power and cost (SWaP-C). Reduction in the size and power consumption of any system that retains the same or greater performance is valuable, especially where space and weight are at a premium, like on aircraft, ships and submarines. For instance, a soldier might have a mission that lasts nine hours, but the radio's battery may last only six hours. With leading-edge process nodes, a radio’s battery life may be extended to last as long as a cell phone’s while maintaining the military’s unique security needs.”

U.S. vs. Foreign Semiconductor Production: A Growing Gap

In the 1990s, the U.S. commanded 37% of the global semiconductor market. Today, that share has dwindled to just 12%, as shown in Table 1, while Asian countries like Taiwan and South Korea now dominate. This shift reflects not only the rapid investment in advanced chip technology in Asia but also the slowing pace of U.S. manufacturing growth. Taiwan, for instance, controls over 60% of the semiconductor market today, while the U.S. struggles to regain its footing in cutting-edge chip production.

This rapid decline in U.S. production has serious implications, not only for economic competitiveness but for national security as well. The $52 billion CHIPS Act seeks to reverse this trend, but given Asia’s dominant lead, it's clear the U.S. faces a steep climb to restore its place in the global semiconductor industry.

The U.S. Semiconductor Fab Environment

In Table 2, I show an extract from The Information Network’s (www.theinformationnet.com) database on global fabs.