Why Gadolinium Is the Hidden Frontline in the U.S.-China Rare Earth Trade War

In over four decades tracking the intersection of technology and global supply chains, I’ve seen few threats as underappreciated — and as immediate — as the one facing MRI imaging.

While most discussions about rare earths focus on electric vehicles and wind turbines, it’s gadolinium — a heavy rare earth essential to MRI contrast agents — that poses one of the greatest strategic risks to U.S. healthcare providers and medical device firms.

Based on exclusive analysis from my latest report, Rare Earths Elements in High-Tech Industries: Market Analysis and Forecasts Amid China’s Trade Embargo, the market concentration, pricing power, and trade sensitivity of gadolinium deserve urgent attention.

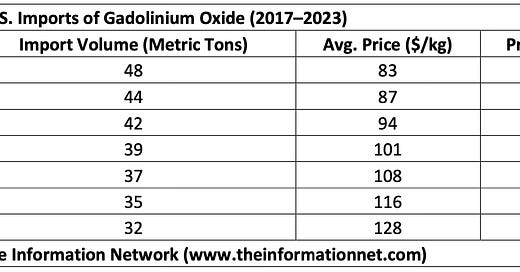

Gadolinium import volumes have declined every year since 2017, even as average import prices have surged more than 50%. Despite U.S. policy efforts, China still accounts for more than 90% of this supply chain.

The real concern is what happens next. Gadolinium is not just difficult to source outside China — it is also a material with no viable substitute in MRI applications. Any disruption in supply has immediate consequences for hospitals, imaging centers, and companies manufacturing contrast agents.

Why Gadolinium Matters — And Who Is Most Exposed

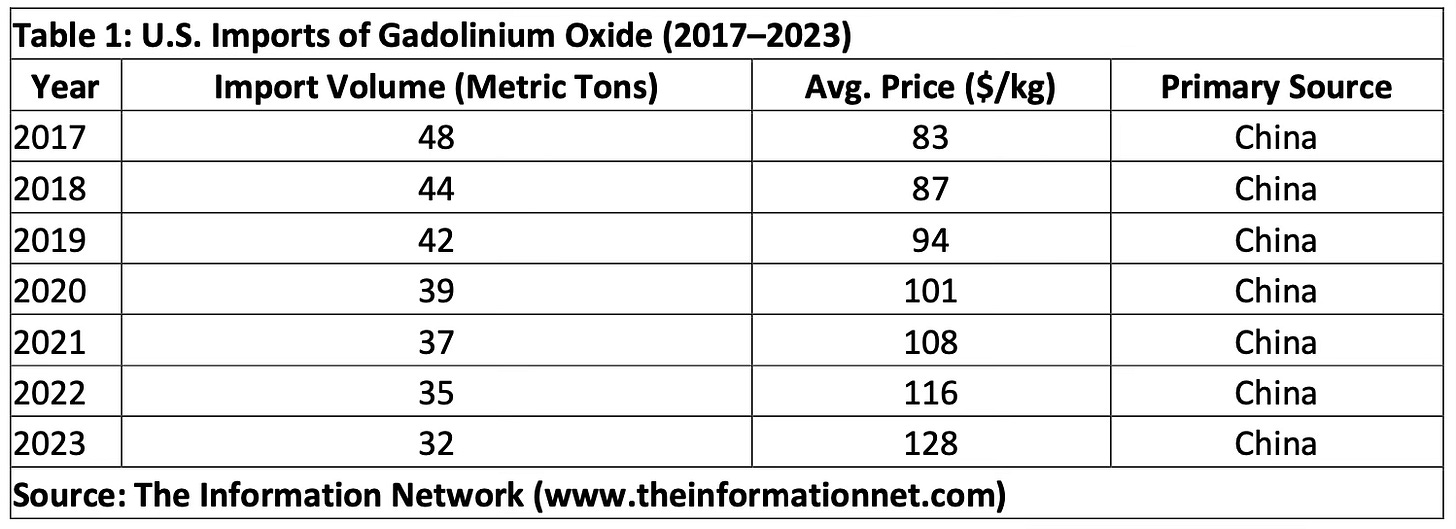

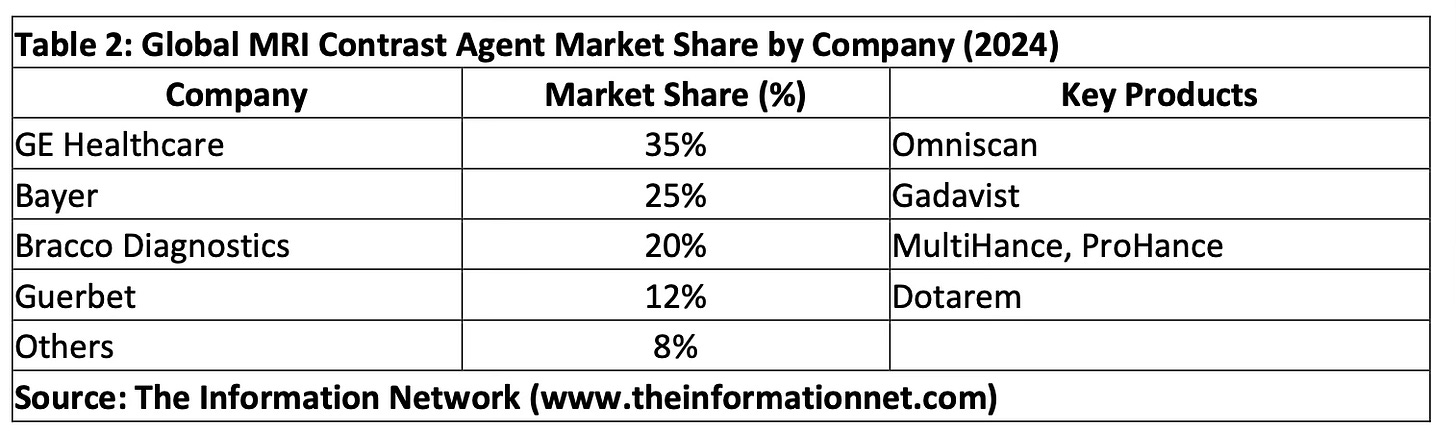

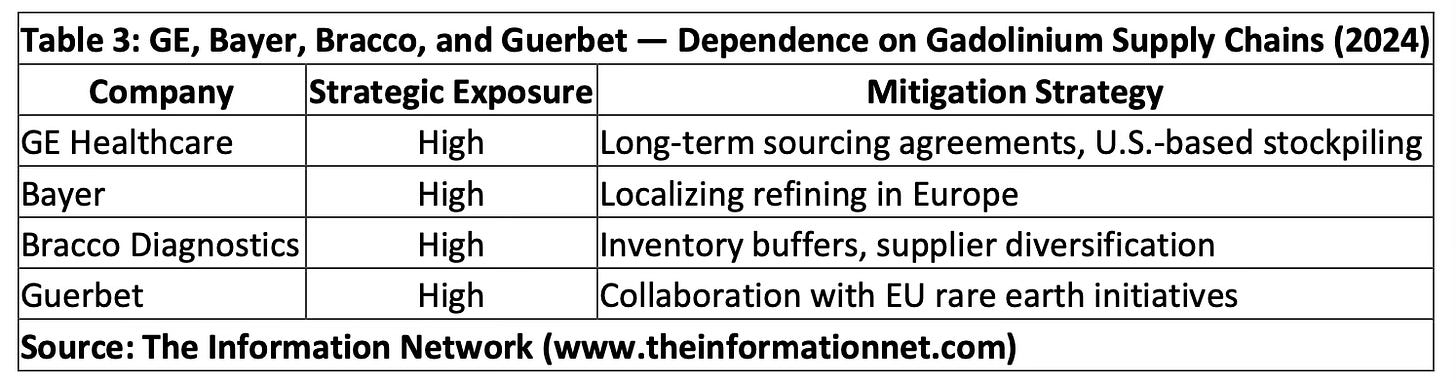

Gadolinium-based contrast agents (GBCAs) are used in roughly 30 million MRI scans annually. Four companies dominate the market: GE Healthcare (GEHC), Bayer (BAYRY), Bracco Diagnostics (Private), and Guerbet (GBT.PA). These firms collectively account for over 90% of the GBCA market.

All four rely on refined gadolinium oxide — almost exclusively sourced or processed in China — as a critical input. Even a modest disruption could lead to shortages, cost increases, and delayed diagnostics across healthcare systems.

This chart is sourced from my report: Rare Earths Elements in High-Tech Industries: Market Analysis and Forecasts Amid China’s Trade Embargo.

In the report, I also examine the broader impacts on aerospace, electronics, and defense, including the rising risk of strategic export bans by China in retaliation for U.S. policy actions. My forecast models multiple scenarios, from tariff escalation to a full export embargo on rare earths like gadolinium, dysprosium, and neodymium.

This Article Is Based on One of My Flagship Reports

The insights and data in this article come from my report:

To celebrate 40 years of The Information Network, I’m offering this report — along with 11 others — at a special 1985 price of just $995 each (regularly $4,995). That’s a $4,000 savings per report.

You’ll also receive the 2025 update FREE when it’s released later this quarter — a $4,995 bonus value.

How to Order:

1. Go to 👉 www.theinformationnet.com

2. Click on Order Reports

3. Choose any of the 12 eligible reports

4. In the cart, click “Enter a promo code”

5. Use code: 40Years

6. Final price: $995 per report

7. Offer valid through April 4, 2025

If you have any questions or need help ordering, contact me directly at:

📩 inquiry@theinformationnet.com

Reports Eligible for the 40-Year Anniversary Discount

· Applied Materials: Competitive Analysis of Served Markets

· CMP Equipment and Consumables: Market Analysis and Forecasts

· Metrology, Inspection, and Process Control in VLSI Manufacturing

· Sub-100nm Lithography: Market Analysis and Strategic Issues

· Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends

· Rare Earth Elements in High-Tech Industries: Market Analysis and Forecasts Amid China’s Trade Embargo

· Power Semiconductors: Markets, Materials, and Technologies

· Asia’s Microelectronics Market: China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, and Vietnam

· Flip Chip / WLP Manufacturing and Market Analysis

· The Hard Disk Drive (HDD) and Solid State Drive (SSD) Industries: Market Analysis and Processing Trends

· High-Density Semiconductor Packaging: Market Analysis and Technology Trends

· 3D TSV: Insight on Critical Issues and Market Analysis

Final Thought

This is just a glimpse of what’s inside the full report — relied upon by leading hedge funds, strategic planners, and multinational firms across the globe. If you’re managing exposure to high-tech supply chains, this is the rare earth intelligence you need right now.

Remember, knowledge is King if investing in the high-tech market. I have that knowledge by analyzing this market since 1985 (40 years) and can help in not only your investing needs, but also for companies developing a business plan/strategy.