WFE Analysis For 2024: Sell Side Analysts Are Slowly Agreeing With Me

I forecast Wafer Front End (WFE) spending by major semiconductor manufacturers is projected to decrease by 5.5% in 2024, indicating a potential slowdown in equipment investments.

Despite strong AI growth as a tailwind for IC sales, AI chip manufacturer TSMC anticipates WFE spend will be flat in 2024.

Citi and Mizuho Securities lowered its outlook for semiconductor equipment spending

Applied Materials will be the most impacted, since in just Q2 2024 it lost $300 million from cuts by Intel as well as $750 million in sales to China.

In my January 29, 2024 article on another network entitled Semiconductor Equipment Downturn Will Continue Through H1 2024, I estimated that:

“I estimate the WFE semiconductor equipment market will increase by 1% in 2024. For the back end, because of the demand for increased advanced packaging, the back-end portion of the equipment market could increase as much as 10% in 2024. Growth will be negative in the first half, followed by an uptick in the second half.”

I also noted in my article that:

“In the past week, leading semiconductor equipment companies ASML, Lam Research (LRCX), and KLA (KLAC) have announced earnings and provided guidance for 2024. All three forecast that 2024 will be similar to 2023, with only LRCX expecting growth of about 5% YoY.”

Final results for WFE show a growth of 2.5% YoY.

In my September 8, 2024 Substack article entitled Semiconductor Equipment Market Pointing to Negative Growth in 2024, I forecast that:

“Wafer Front End (WFE) spending by major semiconductor manufacturers is projected to decrease by 5.5% in 2024, indicating a potential slowdown in equipment investments.”

My forecast was based on a bottoms-up analysis of WFE spend by leading semiconductor companies, according to my report at entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts. My 2024 estimate was significantly impacted by Intel’s (INTC) drop from $26.5 billion in 2023 to $20 in 2024 and further to $18 billion in 2025. These cuts, and additional business lamentations, were a result of a disastrous earnings call on August 1.

Sell-Side Analysts are Lowering 2024 WFE Growth

Wafer fabrication equipment spending is expected to remain flat in 2024, with a projected 2% year-over-year increase in 2025, according to Mizuho analyst Vijay Rakesh. Previously, Rakesh estimated a 3% to 4% growth for 2025, while the broader consensus pointed to a higher increase of 7% to 10%. As a result, Rakesh adjusted his price targets, lowering Applied Materials to $225 from $245 and reducing Lam Research to $950 from $1,050. Earlier in the week, Citi analyst Atif Malik lowered his forecast for 2024.

Catalysts for Growth

In this article, I want to address what the catalysts are for positive or negative WFE growth. I previously pointed to chip types catalysts such as logic (and Intel’s contribution to negative growth), or memory, which I discussed in my September 18, 2024 Substack article entitled Micron Technology: Spend Spend Spend Suffer.

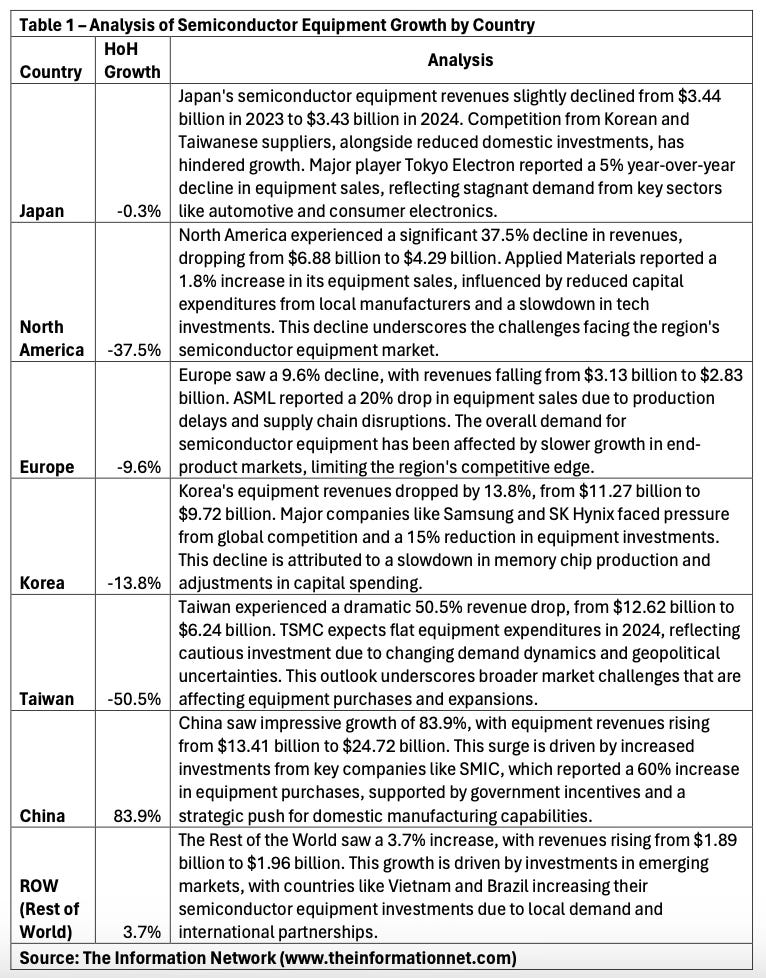

In this article I want to discuss regional catalysts. In Chart 1, I show semiconductor equipment sales by country for the period 1H 2024 vs 1H 2023. In essence, the only country showing HoH growth is China.

Table 1 provides an analysis of semiconductor equipment growth by country.